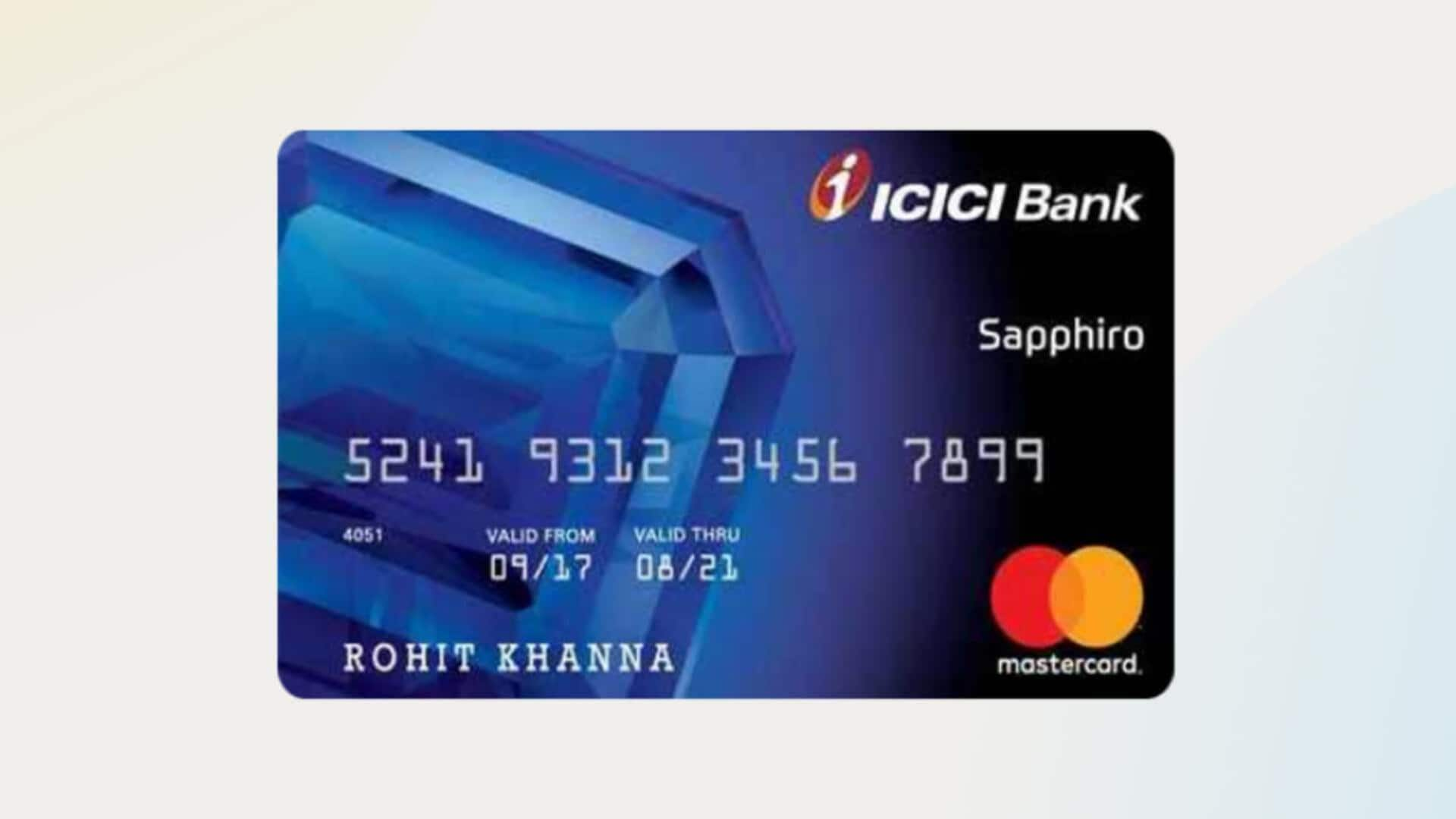

ICICI Bank revises credit card charges, benefits from January 2026

What's the story

ICICI Bank has announced a series of changes to its credit card features and charges, effective next year. The changes will affect reward point earnings, movie benefits, add-on card fees, and transaction-related fees for several popular ICICI Bank credit cards. Among the key changes, access to the BookMyShow Buy-One-Get-One offer will now depend on quarterly spending. Cardholders must spend at least ₹25,000 in the previous quarter, while Instant Platinum card users will lose the benefit entirely from February 2026.

Fee details

ICICI Bank introduces new transaction charges

ICICI Bank will levy a 2% fee on transactions made on online gaming platforms like Dream11, Rummy Culture, Junglee Games and MPL. The charge will also be applicable to payments and similar merchant category codes (MCCs) introduced in the future for such transactions. Further, a 1% fee will be charged on transaction amounts of ₹5,000 or more when loading funds onto third-party wallets like Amazon Pay, Paytm, MobiKwik, Freecharge and OlaMoney.

Additional charges

Transportation transactions over ₹50,000 attract 1% fee

Transactions carried out through transportation select merchant category codes (MCCs) exceeding ₹50,000 will also be charged a 1% fee. This change is applicable to all retail credit card customers of ICICI Bank. The bank has advised its cardholders to review the revised terms and charges carefully, as some benefits continue with limits while others are being withdrawn or repriced.

Rule changes

ICICI Bank's revised rules and their impact

The bank's statement also detailed upcoming changes in credit card features and charges. For instance, the HPCL Super Saver Credit Card will continue to earn reward points on insurance payments only up to ₹40,000 per month at the existing earn rate. However, most changes will come into effect from January 15, 2026 while certain reward caps and benefit withdrawals will apply from February 1.