BlackRock CEO thinks next 20-25 years will be India's era

What's the story

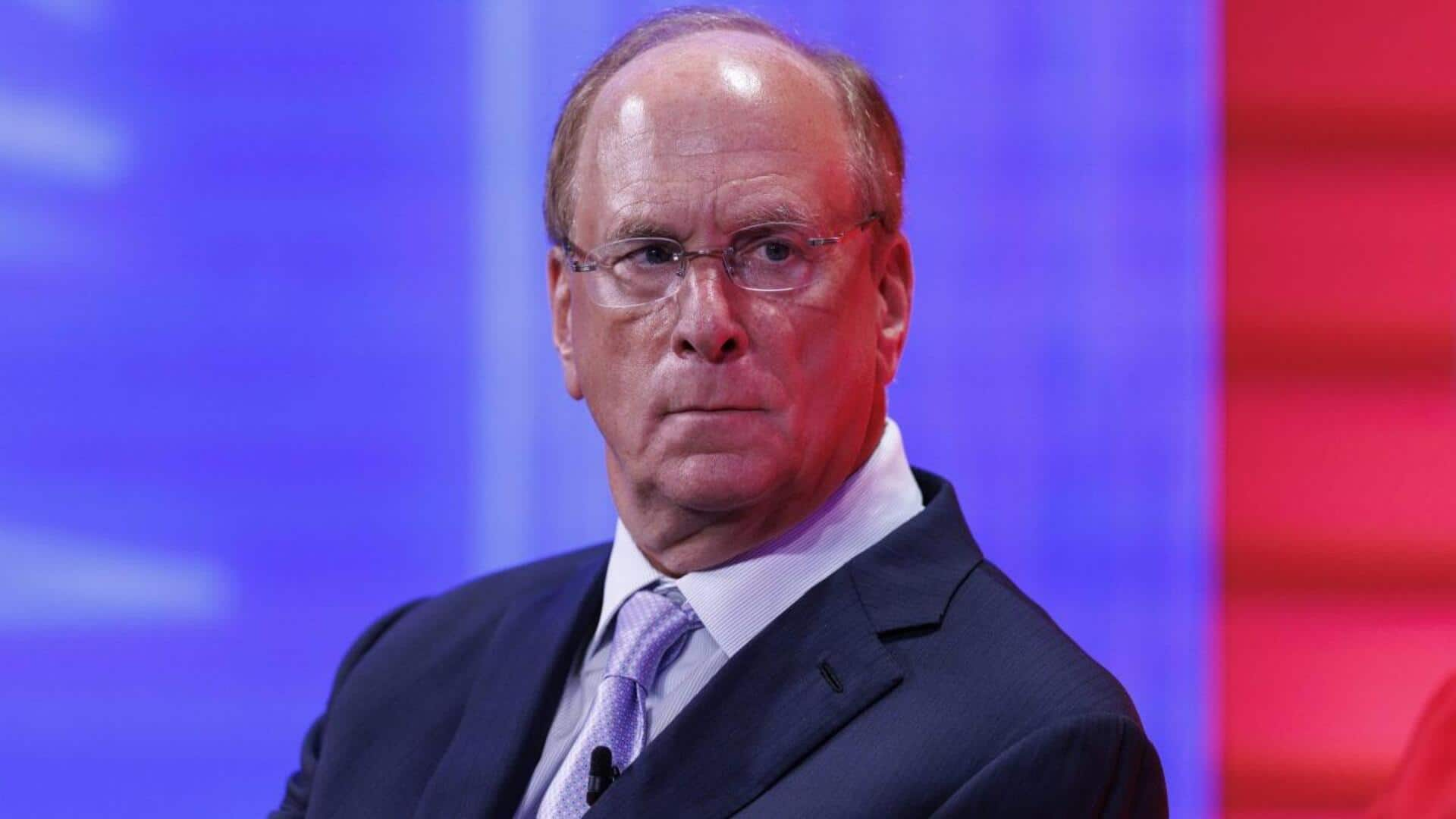

Larry Fink, the CEO of BlackRock, has predicted that the next 20-25 years will be India's era. He made this prediction during a conversation with billionaire Mukesh Ambani at a JioBlackRock event. Fink said India's growth story will increasingly be driven by domestic investment and rapid technological adoption. He emphasized that India is at a defining moment in its economic journey, where domestic investors will play a bigger role in funding growth than foreign capital.

Investment strategy

Need for domestic investment

Fink stressed the importance of getting hundreds of millions of Indians to invest in their country's growth. He said India needs more households to participate in capital markets, whether it be through artificial intelligence, manufacturing, infrastructure or new-age services. As domestic participation deepens, India's dependence on the volatile foreign capital will reduce, making growth more stable and resilient.

Strategic partnership

Jio-BlackRock partnership

Ambani shared how BlackRock's return to India was sealed via a partnership with Jio Financial Services. The result was Jio-BlackRock, a 50:50 joint venture announced in July 2023. Both partners committed up to $150 million each for the digital-first asset management platform aimed at India's rapidly expanding investor base. The platform will leverage Jio's technological reach and BlackRock's global investment expertise to make investing accessible to a wider audience.

Market focus

Core pillar of BlackRock's strategy

For BlackRock, India is more than just another emerging market allocation; it has become a core pillar of the firm's long-term strategy. The world's biggest asset manager ended 2025 with record assets under management of $14.04 trillion. Even amid global volatility, India remains a standout destination for long-term capital compounding. Fink has said that the "fog of global uncertainty" is lifting and capital flows are returning to dynamic markets offering structural growth rather than short-term cycles.