Why SEC has dropped lawsuit against Gemini cryptocurrency exchange

What's the story

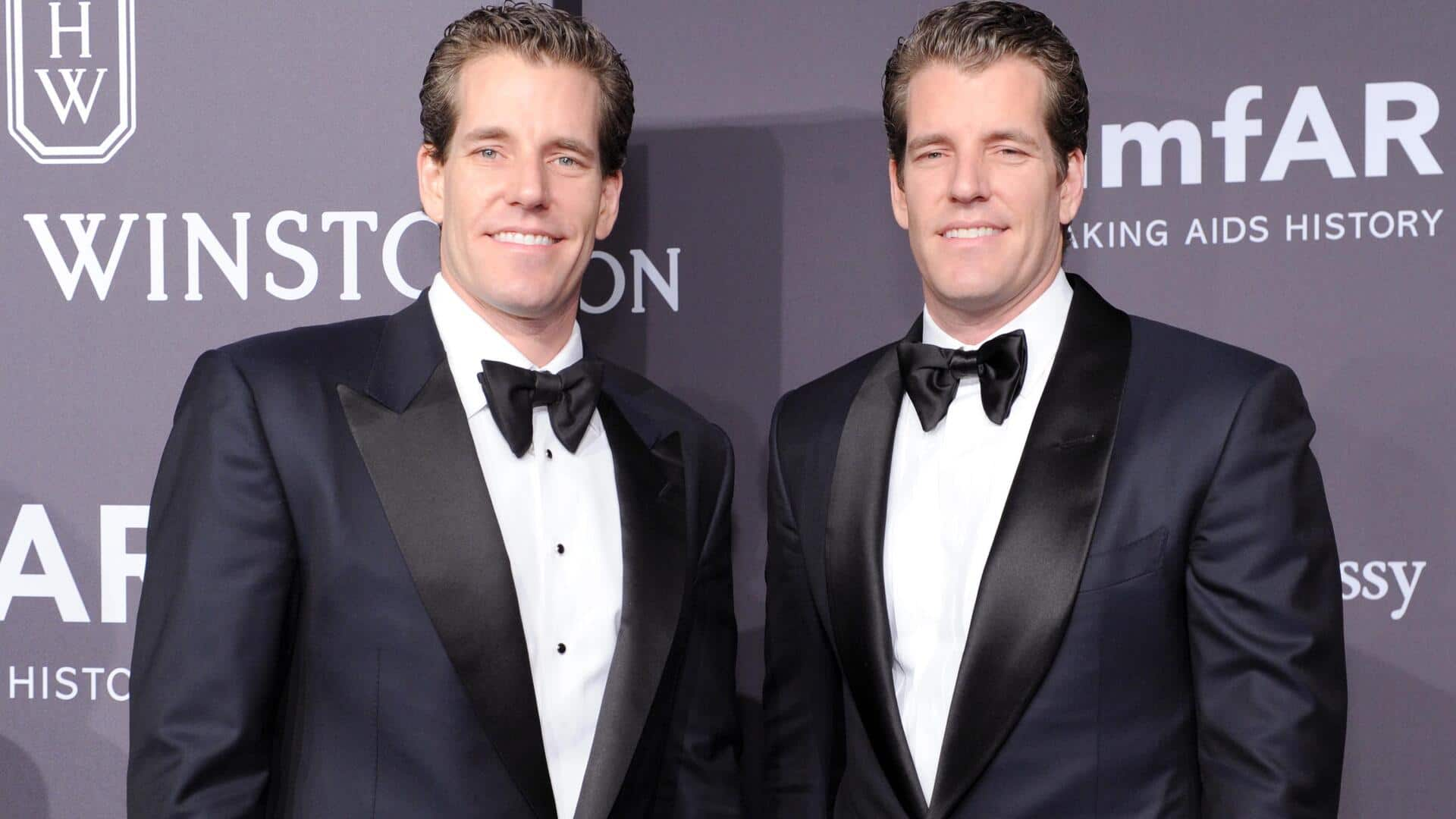

The US Securities and Exchange Commission (SEC) has terminated its lawsuit against Gemini, a cryptocurrency exchange founded by billionaire twins Cameron and Tyler Winklevoss. The case was primarily focused on the collapse of an investment product called Gemini Earn, which left some investors without access to their funds for 18 months. However, a recent joint filing by the SEC and Gemini requested the court to dismiss the lawsuit, citing successful asset recovery.

Asset recovery

Full recovery of assets through bankruptcy process

The SEC and Gemini, now called Gemini Space Station, jointly filed a stipulation in Manhattan federal court to dismiss the case. They cited the full return of crypto assets to Gemini Earn investors via the Genesis Global Capital bankruptcy process between May and June 2024. This was a major factor in the SEC's decision to resolve the lawsuit.

Policy change

SEC's strategy shift under Trump administration

The SEC's approach to crypto enforcement has changed under President Donald Trump. The latter has promised to be the "crypto president," introducing more favorable rules and vowing to make digital currencies mainstream. This shift in policy is evident in the SEC's decision to drop the case against Gemini, even after charging Genesis Global Capital and Gemini Trust Company with illegally selling securities via their crypto lending program in 2023.

Customer protection

Genesis's approach to customer asset return

Unlike other crypto firms that went bankrupt after a 2022 market crash, Genesis was able to return the customers' crypto instead of liquidating a limited pool of assets and paying them back in cash. The SEC noted this "100% in-kind return of Gemini Earn investors' crypto assets through the Genesis Bankruptcy and the settlements" as an important reason for its decision to dismiss claims against Gemini.