NSC v/s government bonds: Which is safer?

What's the story

The National Savings Certificate (NSC) and Indian government bonds are two popular investment options for those looking for safety and guaranteed returns. Both are backed by the government, making them low-risk options for investors. However, they differ in terms of tenure, interest rates, and liquidity. Knowing these differences can help you choose the right investment option according to your financial goals and risk appetite.

NSC explained

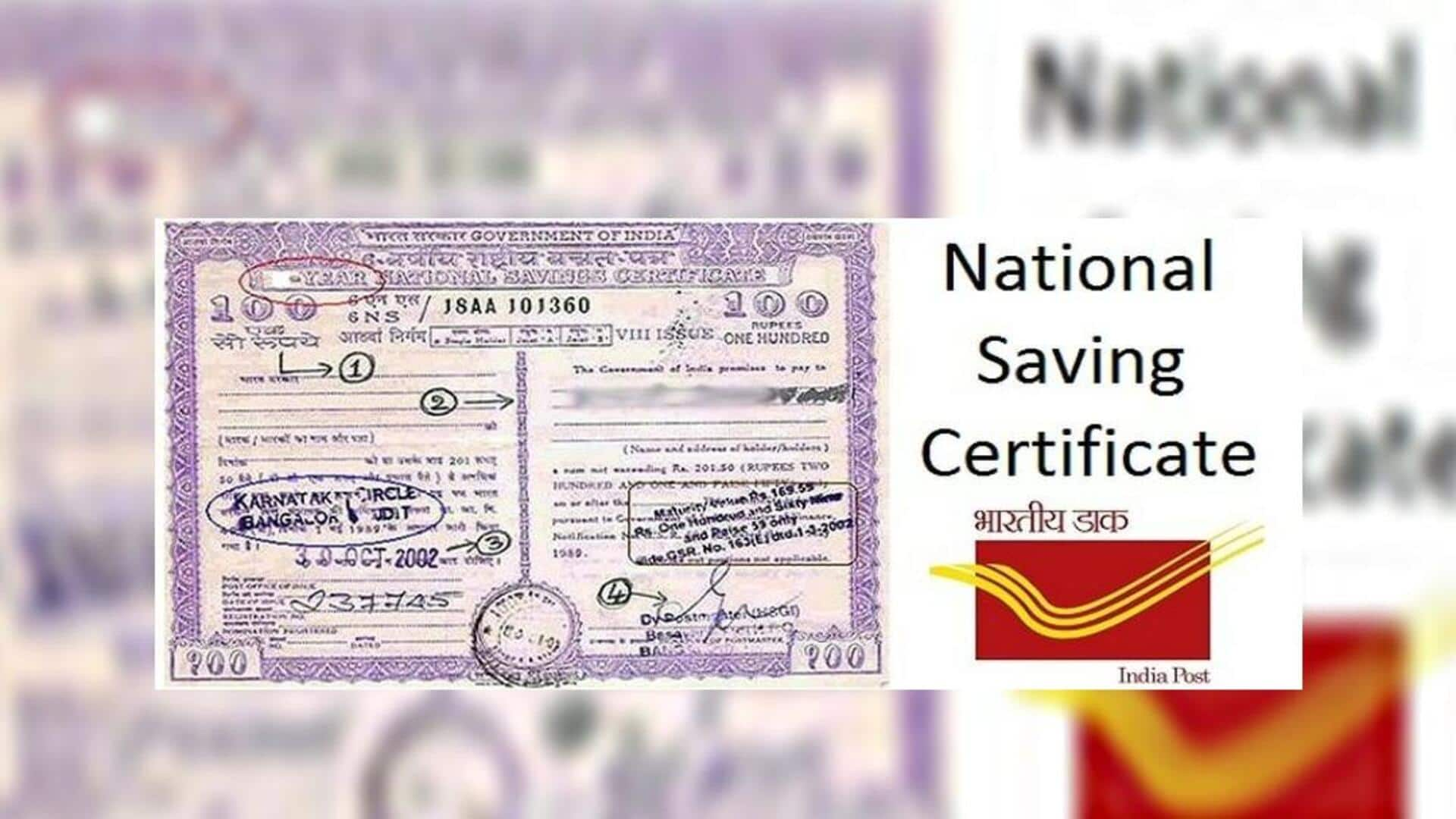

Understanding National Savings Certificate

The National Savings Certificate is a fixed-income investment scheme available at post offices across India. It has a tenure of five years, with the option to reinvest upon maturity. NSC offers a fixed interest rate, which is currently around 7%, per annum. The interest is compounded annually but paid out only at maturity or when the certificate is encashed early. It also qualifies for tax deductions under Section 80C of the Income Tax Act.

Bonds explained

Exploring Indian government bonds

Indian government bonds are debt securities issued by the Reserve Bank of India on behalf of the government. These bonds come with different maturities ranging from one year to 30 years or more. The interest rates vary according to the bond's duration but are usually in line with market rates, which can be slightly higher than NSC's fixed rate. Unlike NSC, these bonds can be traded in secondary markets, providing liquidity.

Rate comparison

Comparing interest rates and returns

While NSC offers a fixed interest rate, Indian government bonds provide variable rates based on market conditions. This means that if you invest in government bonds, your returns may be higher or lower than expected, depending on how the market performs. However, if you prefer guaranteed returns over a fixed period, NSC's fixed rate may be more appealing.

Liquidity insights

Evaluating liquidity options

Liquidity is an important factor to consider when choosing between NSC and government bonds. NSCs have limited liquidity as they cannot be withdrawn before maturity without penalty, except under certain conditions (like emergencies). On the other hand, government bonds can be sold in secondary markets before maturity, giving investors more flexibility to access their funds when needed.