Post office monthly income scheme v/s FD: Which is better?

What's the story

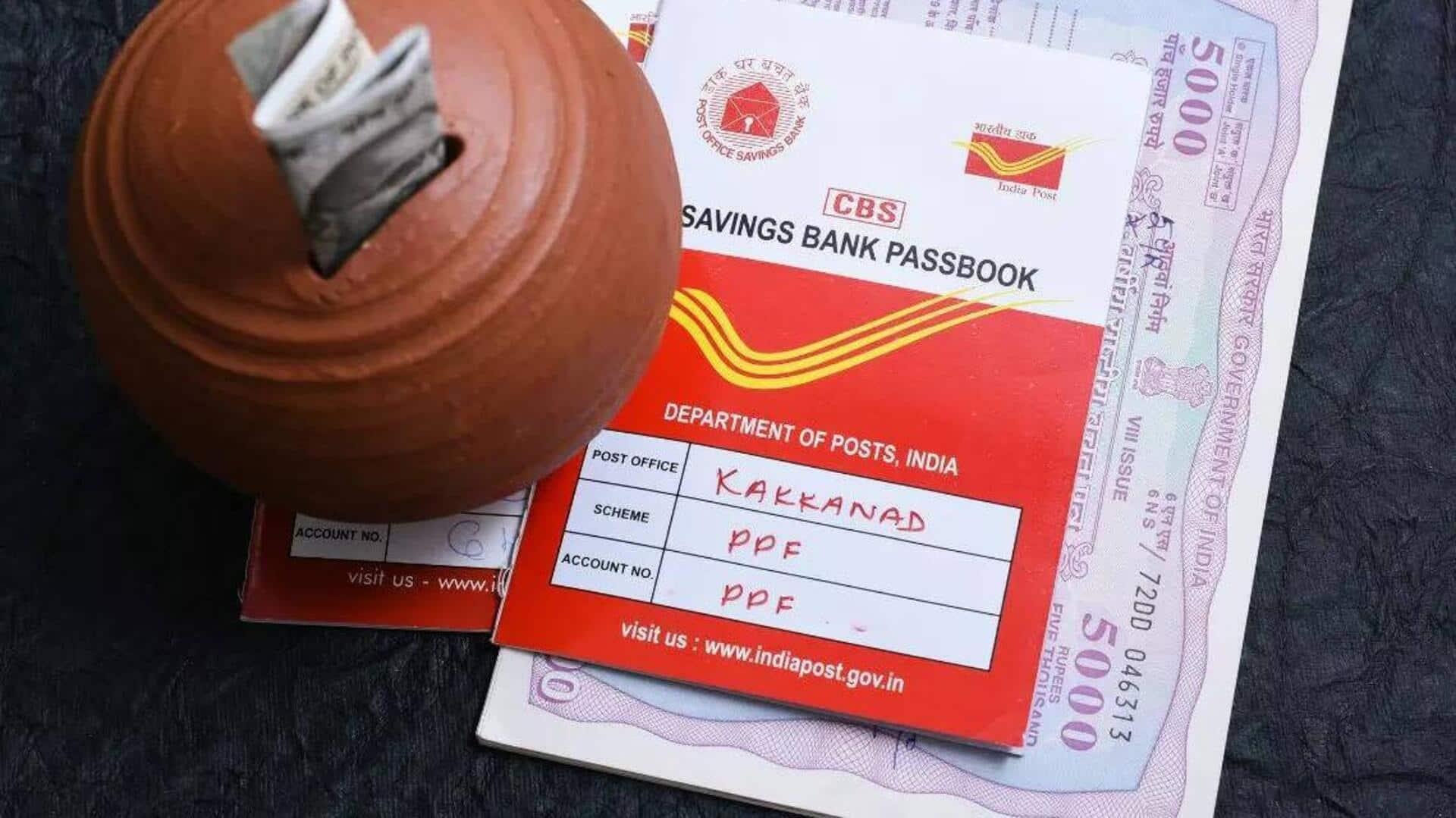

The Post Office Monthly Income Scheme (POMIS) and fixed deposits (FDs) are two popular investment options that provide regular income. Both have their own benefits and drawbacks, making them suitable for different kinds of investors. While POMIS provides monthly payouts, FDs usually pay interest quarterly or at maturity. Knowing the difference between the two can help you make an informed decision based on your financial goals.

Monthly payouts

Understanding PoMIS

POMIS is a government-backed savings scheme that provides a fixed monthly income for a period of five years. The minimum investment is ₹1,500, and the maximum is ₹4.5 lakh for individuals and ₹9 lakh for joint accounts. The scheme currently offers an interest rate of 6.7% per annum, paid monthly. This makes POMIS ideal for those looking for regular cash flow without any risk.

Quarterly interest payments

Exploring fixed deposits

Fixed deposits are offered by banks and financial institutions where you deposit a lump sum for a specified tenure in return for interest payments. The interest rates on FDs are usually higher than those of savings accounts but lower than POMIS rates in some cases. FDs pay interest quarterly or at maturity, depending on the terms agreed upon at the time of investment.

Safety considerations

Risk factors involved

Both POMIS and FDs are considered safe investments, as they are backed by government schemes or regulated by financial institutions with deposit insurance. However, it is important to note that while POMIS has a fixed return, FD rates may vary depending on market conditions at the time of renewal or new deposits.

Accessing funds quickly

Liquidity aspects

Liquidity refers to how easily you can access your invested funds without penalties or loss of interest. POMIS has a lock-in period of five years with no premature withdrawal option without penalty after one year from account opening date. On the other hand, FDs offer premature withdrawal options, though it may incur penalty charges depending on the institution's policy.