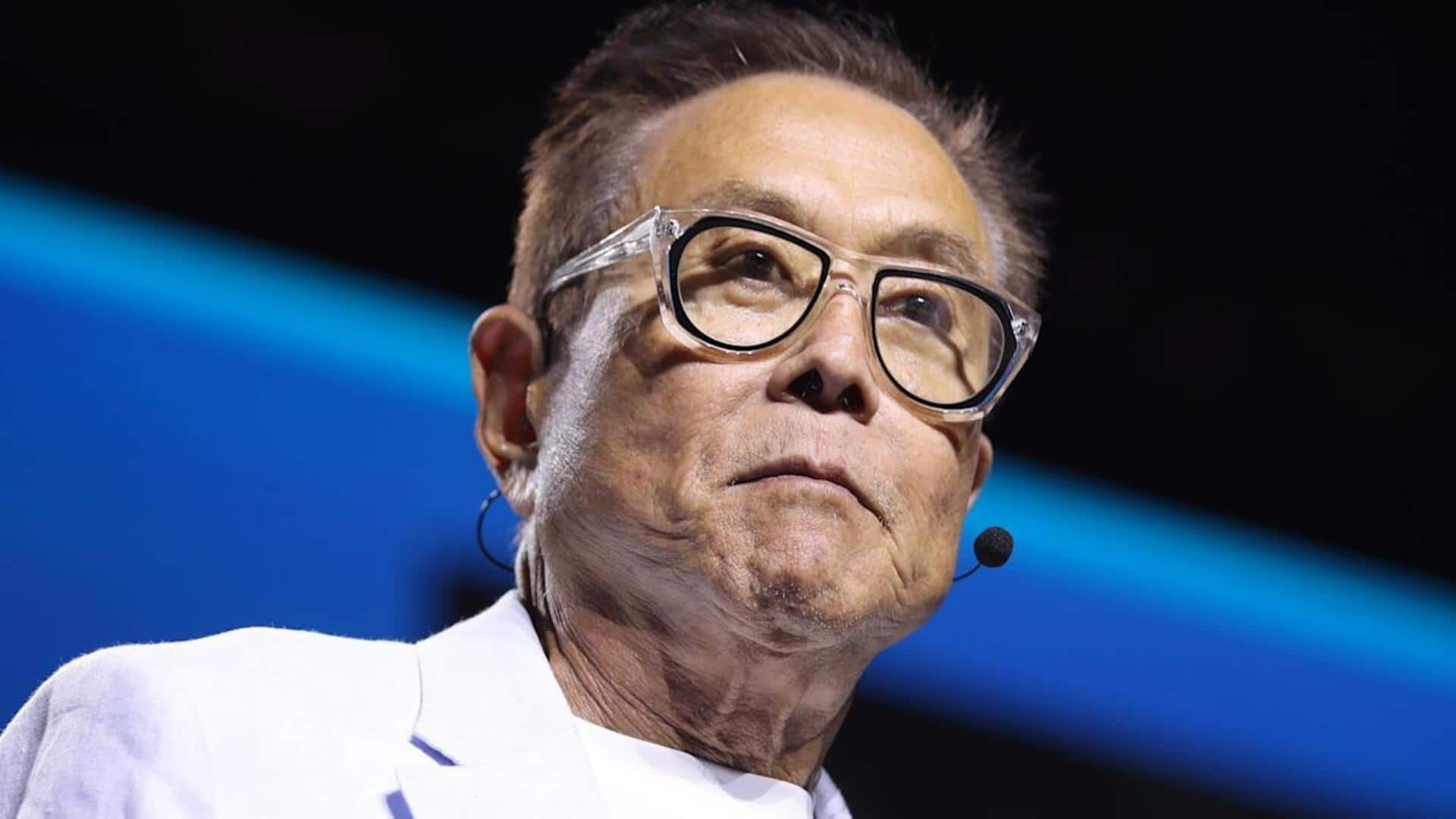

Why Robert Kiyosaki is skeptical of investing in digital silver

What's the story

Robert Kiyosaki, the author of Rich Dad Poor Dad, has long been skeptical of paper assets. He has often advised investors to prefer physical assets over paper investments that are little more than promises. Now, he is using the global silver market as an example of this risk. His comments come as silver prices continue to hit record highs, nearing ₹3.2 lakh/kg on the MCX and hitting a record $94.74 per ounce in international markets for March delivery Comex contracts.

Market analysis

Kiyosaki's critique of the Western silver market

Kiyosaki took to Facebook to criticize the Western silver market, where most trading is done on paper through futures contracts, derivatives, and other financial instruments. He noted that most trades are settled in cash with little physical silver changing hands. This system works because banks and large institutions sell silver exposure they never intend to deliver as buyers rarely ask for the metal. "This is not a conspiracy," Kiyosaki said. "It's how the system has worked for decades."

Contrasting strategies

China's approach to silver buying

Kiyosaki is particularly concerned about China's approach to silver buying. He said Chinese buyers are not playing "paper games" but are instead purchasing physical metal such as bars and deliverable supply. They are even willing to pay premiums of $10 or more per ounce over Western spot prices. This, he argues, creates a two-tier pricing system with one price in the physical market and another in the paper market.

Price divergence

Insights on silver price premiums

Kiyosaki believes the premium in silver prices is due to three factors: rising industrial demand, limited above-ground inventories, and tight physical supply. He said futures markets can create unlimited claims but mines cannot produce metal on demand. This trend of silver buying in China indicates a focus on availability rather than "spot." Kiyosaki advises, "When there are two prices, believe the one tied to reality."

Market warning

Caution against paper pricing decoupling

Kiyosaki isn't predicting a spike in silver prices but is highlighting how stress in the system manifests. He said stress appears gradually via persistent premiums, delivery concerns, regional price divergence, and price gaps. "History shows that when physical markets decouple from paper pricing, the eventual adjustment is never gentle and rarely smooth." He warns that "Silver will not run out loudly. It disappears quietly — right before the price resets."