#FinancialBytes: What is the difference between PAN and TAN?

What's the story

Two of the most important documents for taxpayers and tax-collectors in India are the Permanent Account Number (PAN) and the Tax Deduction and Collection Account Number (TAN). While PAN is issued to individuals and organizations which have to pay taxes, TAN is for businesses and organizations that deduct/collect taxes at source. Here, we explain the difference between the two.

PAN

What is PAN card?

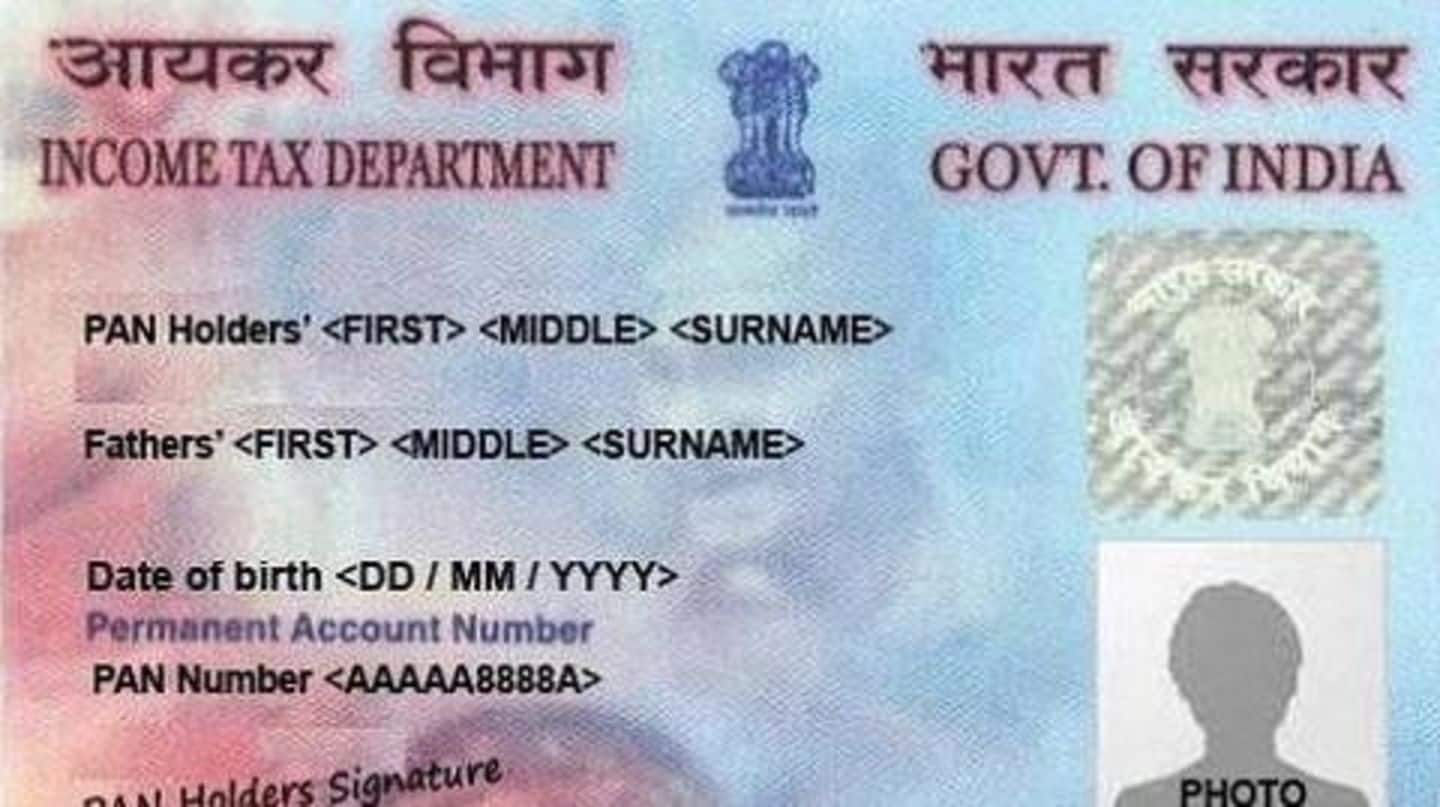

Permanent Account Number (PAN) is a unique, ten-digit alphanumeric identity issued by the Income Tax Department to all individuals as well as organizations which pay taxes. PAN facilitates instrumental financial transactions such as tax payments, entering certain financial contracts, making larger cash deposits, applying for credit/debit cards, filing I-T returns, among others. It also serves as a government-verified proof of identity.

Application

How to apply for PAN card online

First off, visit the official online portal of NSDL for PAN application. Select the application type and category. Enter the required applicant details, and click on 'Submit' button. Next, upload the required documents. Finally, make the application fee payment. After successful submission of the form, you will get an acknowledgement number, that can later be used to track the application.

TAN

What is TAN?

TAN or Tax Deduction and Collection Account Number is a ten-digit alphanumeric identity, allotted to such business entities that deduct or collect taxes at source. Every organization that deducts or collects taxes at source is required to apply for a TAN, which must be quoted in their TDS/TCS returns. After obtaining TAN, TDS returns must be filed quarterly by businesses.

Procedure

How to apply for TAN?

In order to apply for TAN, log on to the TAN application page on the NSDL portal. Next, click on 'Online Application for TAN (Form 49B).' Select the category of deductors from the drop-down menu, and click on 'Select' button. Fill out all the required details in the form. Finally, after making the payment, an acknowledgement slip will be generated. Save this acknowledgement slip.

Information

Final steps

Save the printed copy of the acknowledgement slip and send it to NSDL along with necessary documents. This is the address: NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune-411016