Virat Kohli-backed Go Digit raises $141M funding as IPO opens

What's the story

Indian insurance startup, Go Digit, has successfully secured $141 million from a group of investors as its initial public offering (IPO) opens today. The funding round included prominent investors such as Fidelity, Goldman Sachs, Morgan Stanley and others. Several Indian mutual funds operated by SBI, ICICI, Axis, Tata and Edelweiss also served as anchor backers for the IPO.

Company profile

Go Digit's offerings and IPO details

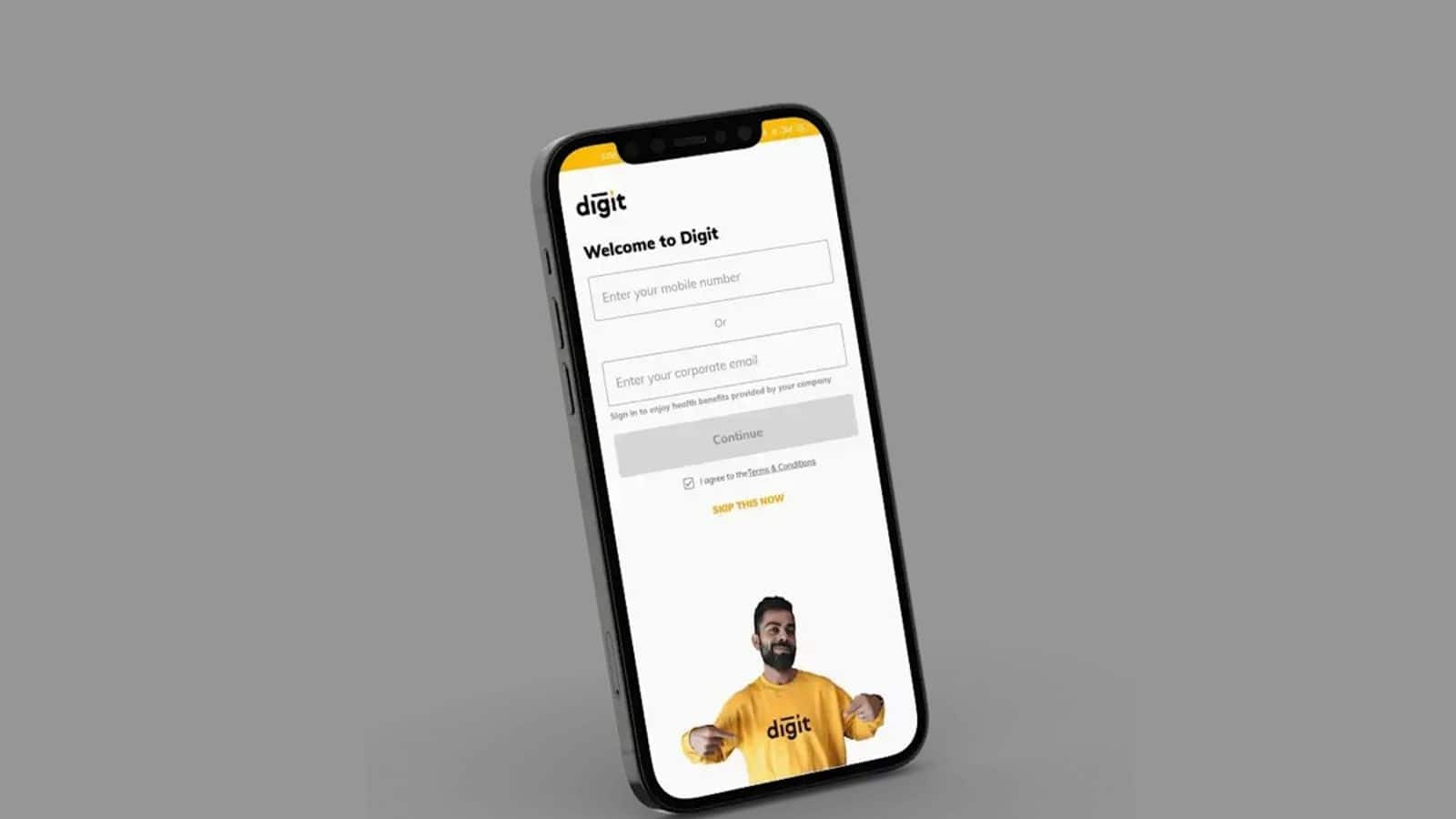

Founded by Kamesh Goyal, a former KPMG executive, Go Digit offers a variety of insurance products such as auto, health, travel, and accidental insurance. The Virat Kohli-backed startup simplifies the process of purchasing and redeeming insurance by enabling users to self-inspect, submit claims, and process service requests via their smartphones. According to its IPO prospectus, the company had approximately 43 million customers and had issued around eight million policies in the nine months ending December last year.

IPO goals

Go Digit's IPO aims and market conditions

The Mumbai-based startup is aiming to raise around $313 million from the IPO, seeking a valuation of about $3 billion. This valuation is roughly 25% lower than its last private valuation of $4 billion. The price band for the IPO, which will close on May 17, is ₹258-272 per share. The listing will happen on May 23. The decision to go public comes at a time when retail investors in India are showing increased interest in tech startup stocks.