India tops emerging markets on strong export growth

What's the story

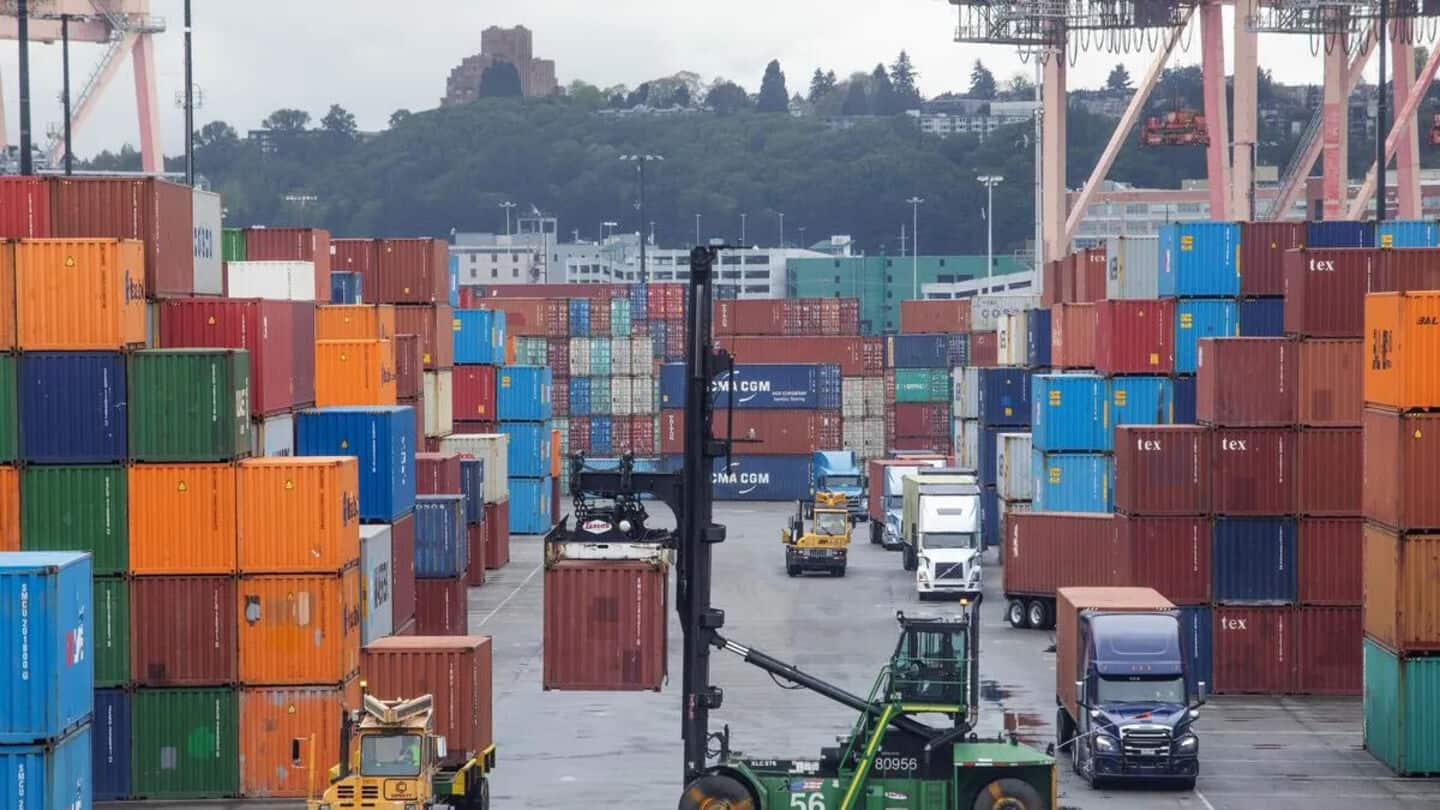

India has outperformed its emerging market (EM) peers in November, thanks to a sharp rise in exports. The country's composite score stood at 71, way ahead of Malaysia and Brazil which scored 62 and 59, respectively. The data comes from Mint's Emerging Market Tracker. Despite a weak rupee and stock market performance, India's export growth was the highest among major EMs at 19.4% year-on-year (YoY) in November, tied with the Philippines.

Export performance

Export growth surpasses peers

India's export growth in November was a sharp recovery from a decline of 11.4% in the previous month. A large part of this increase is attributed to a low base, as exports were at a two-year low in November 2024. Despite high US tariffs of 50%, India exported goods worth $38.1 billion in November, the highest since May, driven by strong month-on-month growth to Spain and China.

Economic indicators

GDP growth and manufacturing PMI boost export performance

India's strong economic performance also contributed to its export growth. The country recorded a robust 8.2% GDP growth in July-September, the highest among its peers. It also posted the second-best manufacturing PMI of 56.6 during this period. These factors helped India offset the relatively poor performance of its currency and ultra-low inflation print for November, which was just 0.7%, much below the medium-term target of 4%.

Market trends

Stock market and currency performance

The Indian stock market rose by 1.2% month-on-month in November, despite foreign investors fleeing the country. FPIs were net sellers in equities for eight months in 2025, with cumulative ₹1.58 trillion withdrawn until December 26. However, India's rupee depreciated by 0.5% against the dollar during the same period, making it the fourth-worst performer among nine EMs tracked by Mint's Emerging Market Tracker.

Economic outlook

Future challenges and opportunities

Despite strong fundamentals, India faces risks that could challenge its top position in the coming months. The rupee has remained weak in December, depreciating around 1% month-on-month. The benchmark BSE Sensex has also declined by about 0.8%. Continuing FPI outflows could further challenge India's position in the coming months. However, December is usually a good month for exports with levels being 9-24% higher compared to November over the last five years.