Amazon ups Indian investment, Flipkart is bidding its time

What's the story

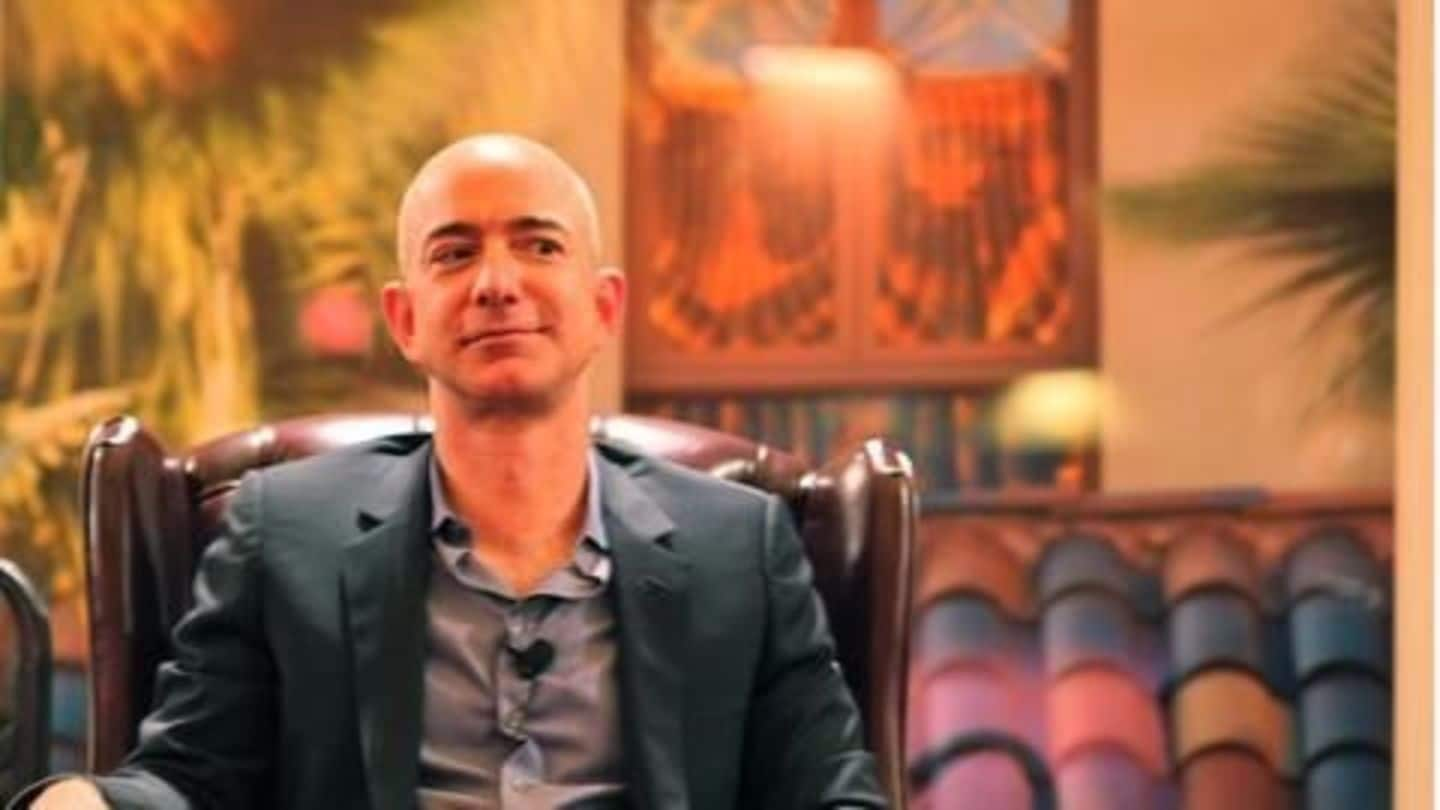

Amazon CEO Jeff Bezos, making good on his promise, has now allotted Rs. 341 crore for Amazon Wholesale India i.e. the wholesale B2B arm of its Indian operations and Rs. 1,680 crore to its Indian online wing. This fresh capital infusion is part of Bezos's $5 billion investment plan, aimed at consolidating the lion's share of the Indian e-commerce space. Here's all about it.

Competition

Amazon means business

Both of these investments were made during the month of May, as per the regulatory filings with the corporate affairs ministry. The agenda remains clear, India is Amazon's next big bet and it is aggressively putting in more money than ever to make sure that it doesn't lose out. The only major entity that stands in its way is the home-grown e-commerce firm Flipkart.

Flipkart

Flipkart needs the merger

Flipkart itself is, however, bogged down with issues of its own. It can't keep tandem with this unbridled spending of Amazon and its Snapdeal merger is still pending. If that merger goes through, SoftBank will come on board to help the firm out by spending a sizable amount on the newly merged entity. In the showdown of money, SoftBank wins hands down over Amazon.

Consumers

A shift from discounts

Both firms are trying out different methods to woo consumers. Flipkart is playing the exclusivity card by increasing the extent of its private brands. The idea is to create unique products with innovative pricing that consumers won't get anywhere else. At the same time, Amazon is going gung-ho with its Prime subscription-based module. Their aim is to create a loyal pool of repeat customers.

Paytm

Paytm is doing its own thing

Meanwhile, Paytm Mall which is owned by Paytm E-commerce Pvt. Ltd, is also doing its bit to consolidate market space. Although it has not done anything drastic to warrant notice, it had hosted its GST sale and has been partnering with several brands, the latest of which was LG Electronics. It is also selling HP and Lenovo models that come with GST filing software.