Hedge fund billionaire warns US facing 'something worse than recession'

What's the story

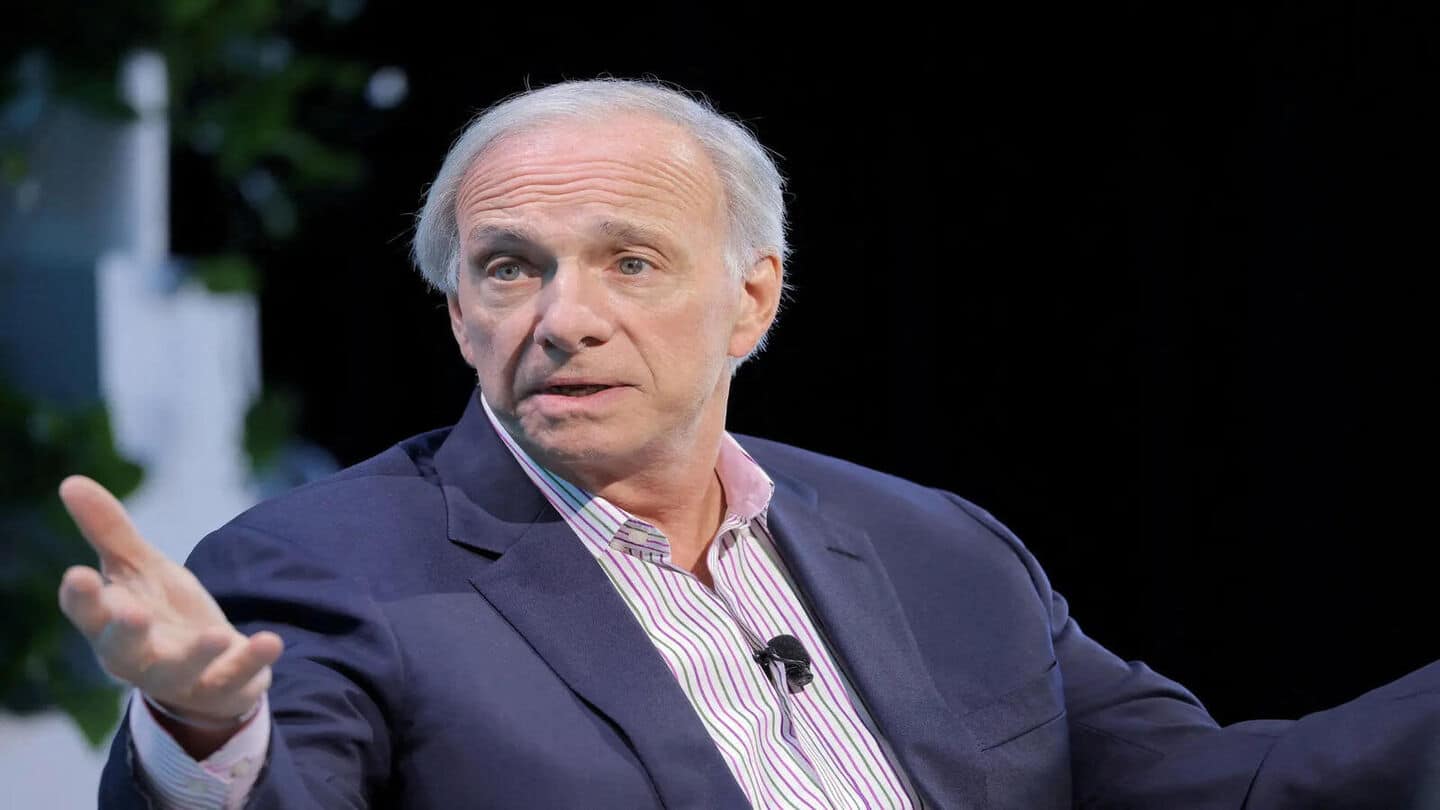

Hedge fund billionaire Ray Dalio has voiced his fears over how Donald Trump's trade policies could affect the US economy. Speaking to NBC's Meet the Press, Dalio warned that "we are at a decision-making point and very close to a recession." However, he also hinted that if these policies aren't handled properly, the country could face "something worse than a recession."

Instability

Concerns over monetary order breakdown

Dalio flagged a "breaking down of the monetary order" as a key concern. He stressed that changes to the monetary order are imperative, as spending levels are unsustainable. His remarks come after global stock markets witnessed fluctuations recently following Trump's tariff policies, which include a whopping 145% tariff hike on imports from China.

Disruption

Historical parallels and disruptive changes

Drawing parallels with the 1930s, Dalio cited "profound changes in our domestic order...and world order." He said, "I've studied history and this repeats over and over again." Dalio warned that tariffs, debt levels, and rising power challenging existing power could lead to disruptive changes in orders or systems.

Management

Dalio's suggestions for managing US's economic problems

Dalio suggested that bringing down the budget deficit to 3% of GDP could help manage trade deficits effectively. He urged US Congress members to take the "3% pledge," warning that failure to do so could lead to a supply and demand problem for debt. This could have consequences worse than a standard recession, he cautioned.

Policies

Tariffs and their impact on global economic challenges

When asked if Trump's tariffs are exacerbating the world's complex challenges, Dalio admitted to the need to build manufacturing and jobs in the US. He stressed that "how that is done...makes all the difference in the world." Despite a temporary pause on tariffs at 10% on all US imports (except Chinese ones) for 90 days, financial experts warn of potential long-term consequences like rapid de-dollarization.