Berkshire Hathaway's Q3 results: Net profit surges 17% to $31B

What's the story

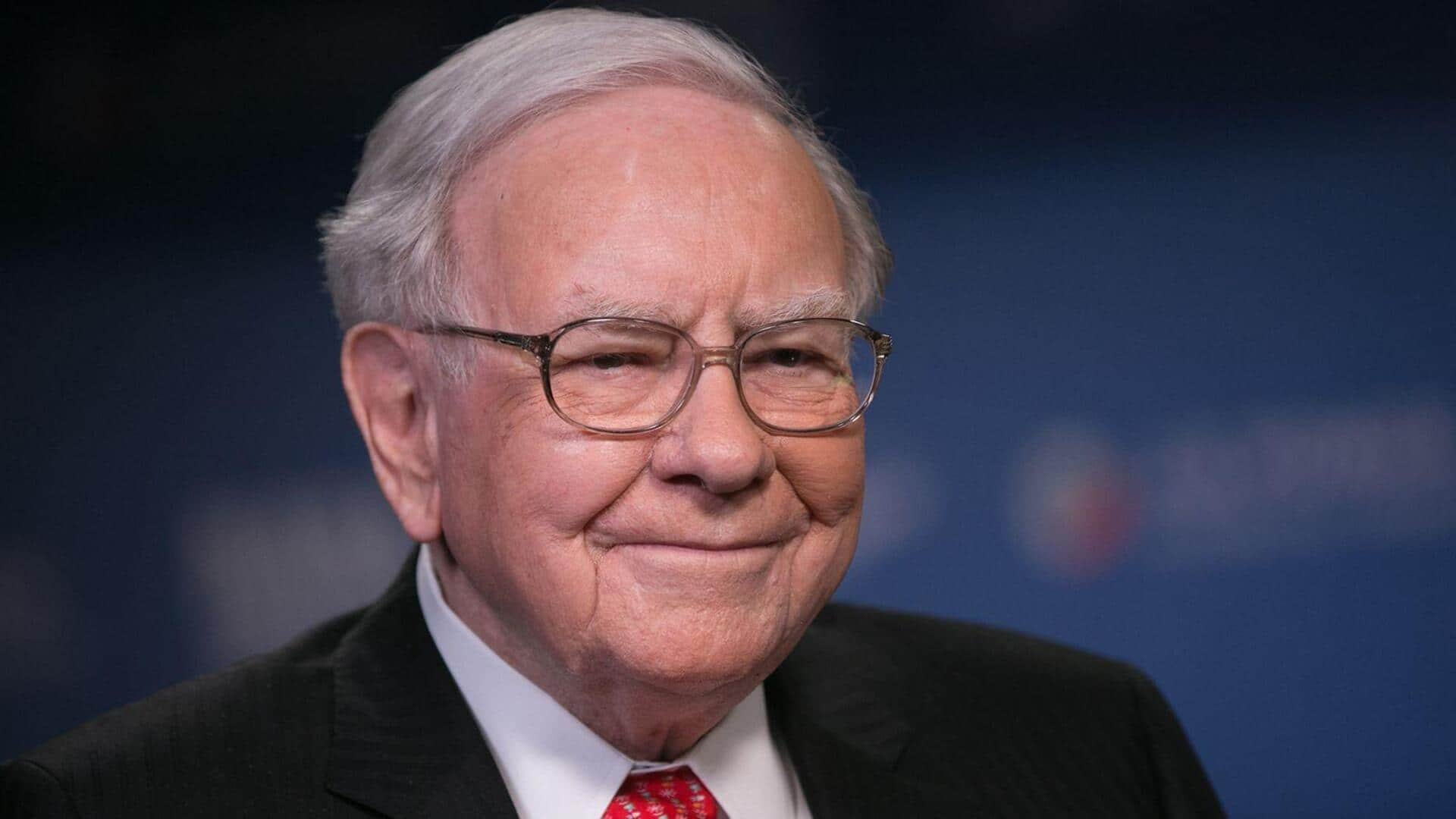

Warren Buffett's Berkshire Hathaway has reported a 17% increase in its quarterly profit. The surge comes on the back of a recovery in its insurance business and investment gains, despite the legendary investor's impending handover of CEO duties to Vice Chair Greg Abel in January. The company posted a profit of $30.8 billion, or $21,413 per Class A share for the third quarter ending September.

Financial highlights

Operating profit jumps to $13.49B

Berkshire Hathaway's operating profit, Buffett's preferred metric for evaluating the company's performance, jumped to $13.49 billion or $9,376.15 per Class A share. This is a significant increase from last year's total operating profit of $10.09 billion. The company also recorded $17.3 billion in investment gains during the quarter, and foreign currency debt holdings added $331 million in profit, compared to a loss of $1.1 billion last year.

Business breakdown

Insurance business drives profits, utilities division sees decline

The strong performance of Berkshire Hathaway has been attributed to its insurance business, which saw fewer catastrophic losses than last year. However, the company's utilities division witnessed a nearly 9% decline in earnings to $1.49 billion. Despite a massive $9.7 billion investment in OxyChem last month, the biggest deal in years, Berkshire's cash reserves remained healthy at $381.7 billion as of end-September.

Leadership transition

Buffett to step down as CEO in January

Buffett, 95, will step down as CEO in January but continue as chairman. The firm's Class A shares closed Friday at $715,740, well below their record of $812,855 reached in May before Buffett's retirement announcement. Analysts expect investors will demand more transparency from Berkshire after Abel takes over, and may also push for dividends if the company can't find better uses for its cash reserves.