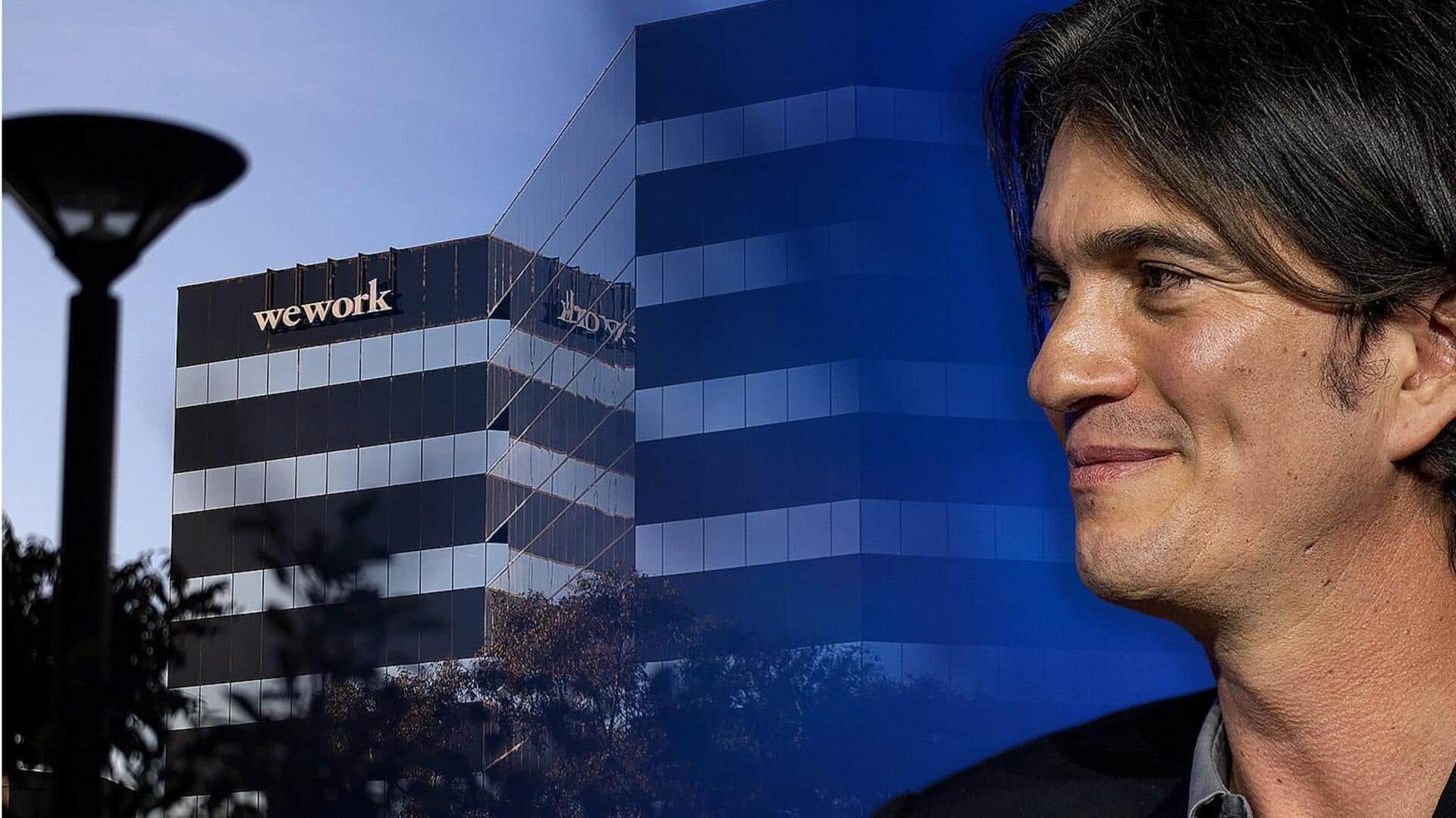

WeWork finalizes bankruptcy deal, rejects founder Adam Neumann's $650M bid

What's the story

WeWork, the shared office space provider, has successfully finalized a bankruptcy deal with its creditors. The agreement includes a new cash infusion from its senior lenders and a settlement with junior creditors. This strategic move dismisses a $650 million offer from Adam Neumann, the company's co-founder and former owner. The announcement was made during a hearing in Newark where US Bankruptcy Judge John Sherwood approved WeWork's restructuring plan.

Debt elimination

WeWork's restructuring plan receives full creditor support

Sherwood's approval of the restructuring plan sets WeWork on a path to exit bankruptcy by the end of May. The plan, now backed by all major creditors, will transfer the company's equity to its senior lenders and wipe out its $4 billion debt. The updated bankruptcy deal includes up to $450 million in new funding from SoftBank, King Street Capital, and Cupar Grimmond, an affiliate of WeWork technology partner Yardi Systems.

Ownership shift

Equity distribution and credit facilities post-restructuring

Following the restructuring, Cupar Grimmond will own the majority of WeWork's equity while SoftBank will hold 16.5%. SoftBank's stake could potentially increase to 36% depending on how WeWork decides to equitize some separate credit facilities it has funded. Steven Serajeddini, a lawyer for WeWork, disclosed at Monday's hearing that settlements were reached over the weekend to gain support from two factions of junior creditors who had previously opposed its restructuring deal.

Cost reduction

WeWork settles with junior creditors, reduces future rent costs

The factions that agreed to support the restructuring include a court-appointed creditors committee and a group of bondholders including Antara Capital. In exchange for their support, WeWork has agreed to pay $32.5 million to its junior creditors, which includes $8.5 million to the bondholders. WeWork has also negotiated a significant reduction in future rent costs, eventually reaching deals that saved it $8 billion. Neumann argues that WeWork is prioritizing the sale to select insiders rather than pursuing the highest bid.