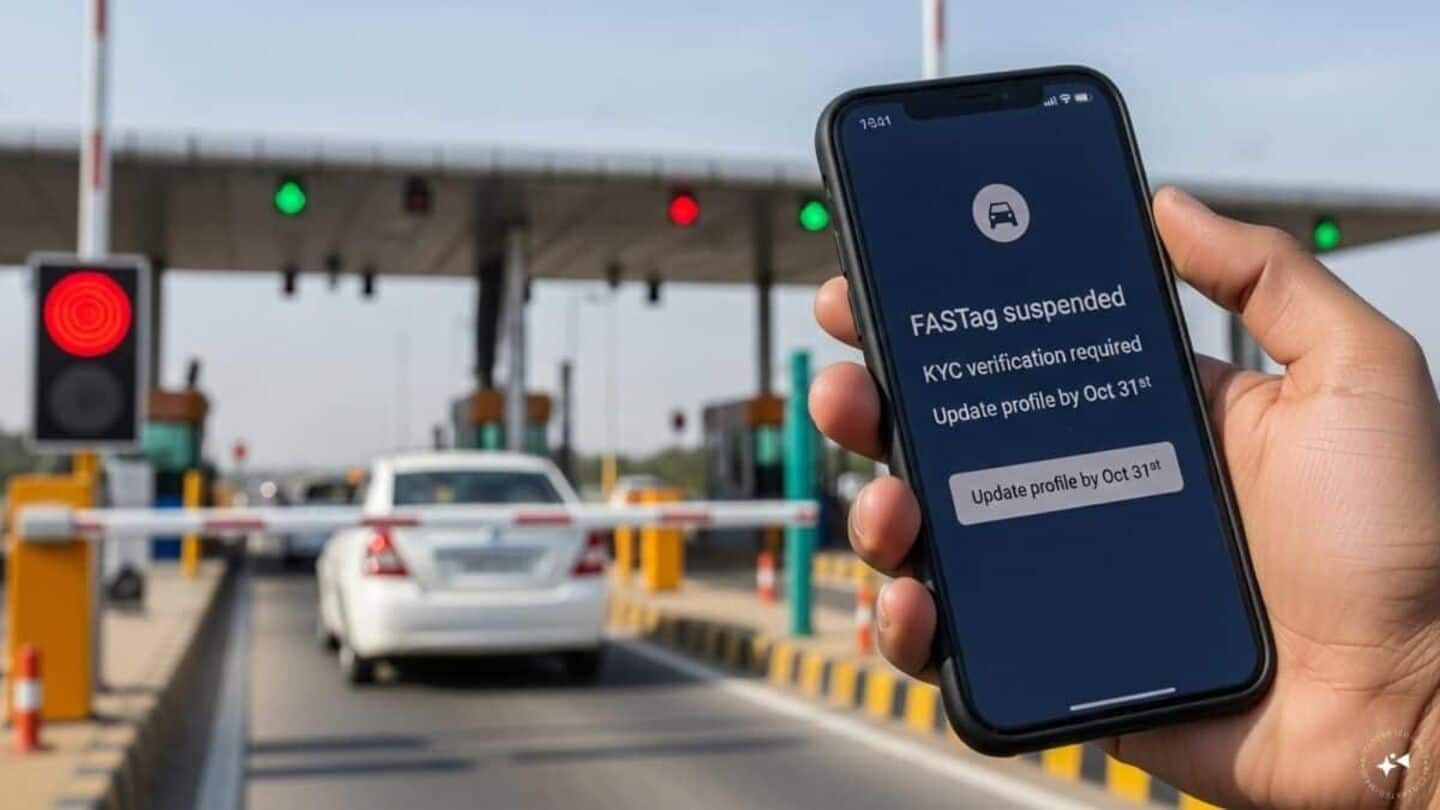

Your FASTag may be deactivated if this verification isn't completed

What's the story

Starting October 31, vehicle owners in India will have to undergo a new verification process called Know Your Vehicle (KYV) to continue using their FASTag at toll plazas. The National Highways Authority of India (NHAI) has said this move is aimed at tightening the system and preventing misuse. However, motorists are not too happy about it as they fear being left stranded with cash-only tolls if they don't complete the KYV process on time.

Verification details

Why is the KYV process being introduced?

The KYV process was introduced after authorities found multiple cases of FASTag misuse, such as keeping loose tags in wallets or using the same tag on multiple vehicles. The new verification system aims to ensure that each tag is properly linked to its respective vehicle and that tolls are categorized correctly. To complete this process, users will have to upload their vehicle's Registration Certificate (RC) showing the number and owner's name, along with valid ID proof (Aadhaar, PAN, passport).

Verification procedure

How to complete the KYV process?

The KYV process can be completed via the website or mobile app of the bank that issued your FASTag. Users will have to log in, click on 'Update KYV' or 'Know Your Vehicle,' upload the required documents, and complete OTP verification. Once verified, the tag will show as "Active and Verified." However, if this verification is not done completely, NHAI has warned that unverified or partially verified FASTags will be automatically deactivated even if there's sufficient balance in their account.

Long-term goals

Motorists fear being stranded at toll plazas

The NHAI hopes that the KYV process will prevent tag misuse and multiple-vehicle fraud, make tracking stolen/sold vehicles easier, reduce errors in toll categorization, and provide better tracking/reporting for users. The authority believes this move will strengthen the digital toll ecosystem in the long run. However, some motorists have called it yet another bureaucratic hurdle similar to KYC (Know Your Customer) procedures that many find cumbersome.