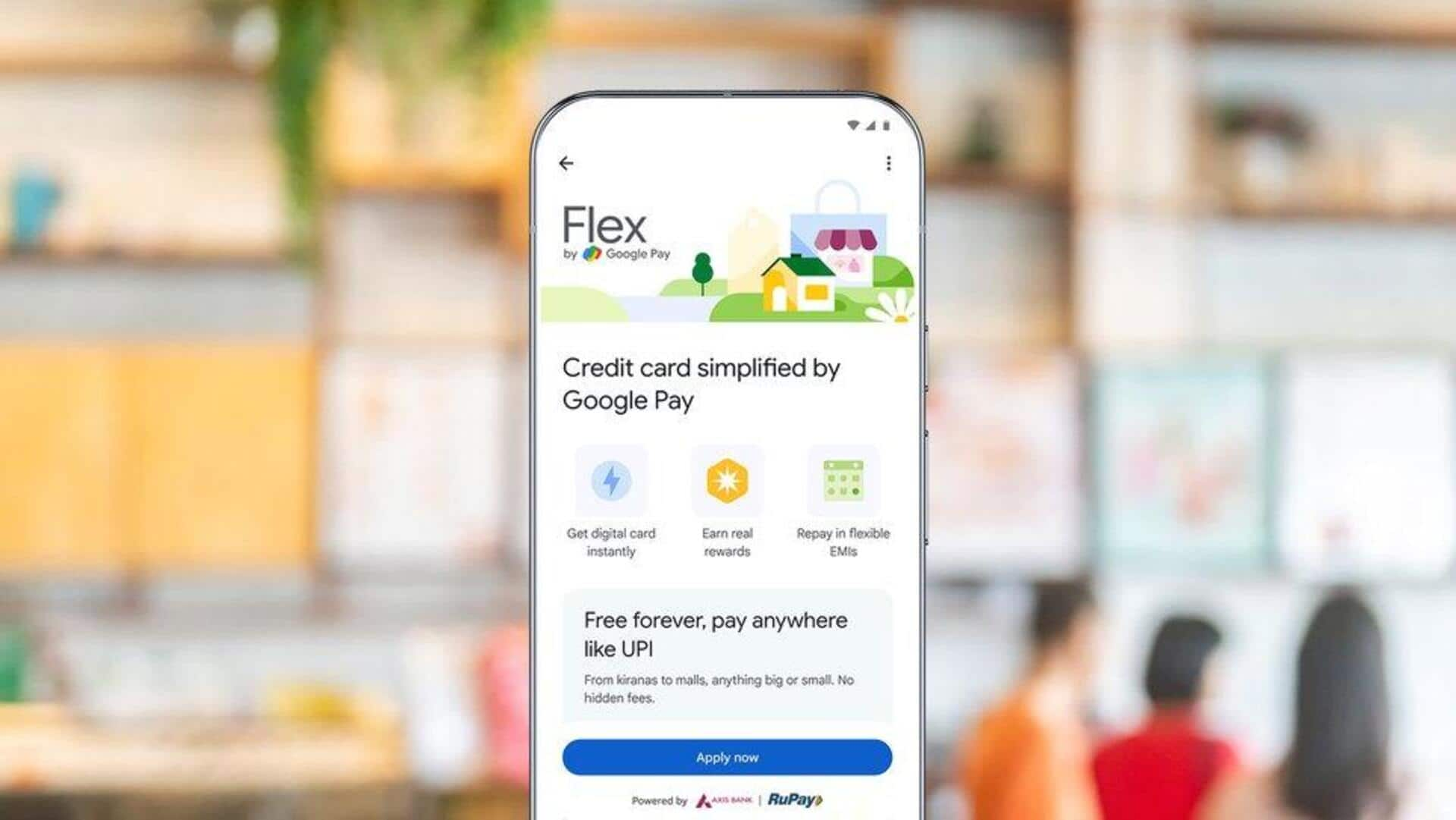

Google Pay launches its 1st-ever credit card in India

What's the story

Google Pay has launched its first credit card offering in India, in partnership with Axis Bank. The co-branded card is based on the RuPay network and can be linked to customers' Unified Payments Interface (UPI) accounts for merchant payments. It offers instant cashbacks or rewards, a feature that sets it apart from industry standards where rewards are credited at the end of a credit cycle or month.

Instant benefits

Google Pay's credit card gives instant rewards

The new credit card from Google Pay offers instant rewards on every transaction. Sharath Bulusu, Senior Director and Product Manager at Google, said, "Where we have innovated is the way you can use your rewards. You earn rewards instantly on every transaction, and you can immediately use it on the very next transaction." This feature is highlighted as a user-friendly innovation.

Repayment options

It offers flexibility in repayments

Along with instant rewards, Google's new credit card also comes with flexible repayment options. Customers can choose to pay their monthly bill in EMIs over six or nine months. Bulusu said, "We figured out that flexibility in repayments and simplicity in repayments matter to users, but it is hard to build and we wanted to solve it before launching the card."

Cashback details

Card offers competitive cashbacks

Google Pay's new credit card offers cashbacks/reward points for payments through its platform and on partner apps/websites, with typical market percentages being 5-10% and 3-5%, respectively. The card also provides cashback on all other payments, including scan and pay for UPI transactions, with general market figures being 1-1.5%. This makes it a competitive option in the market of co-branded credit cards linked to UPI accounts.