Now, apply for instant e-PAN using Aadhaar. Here's how

What's the story

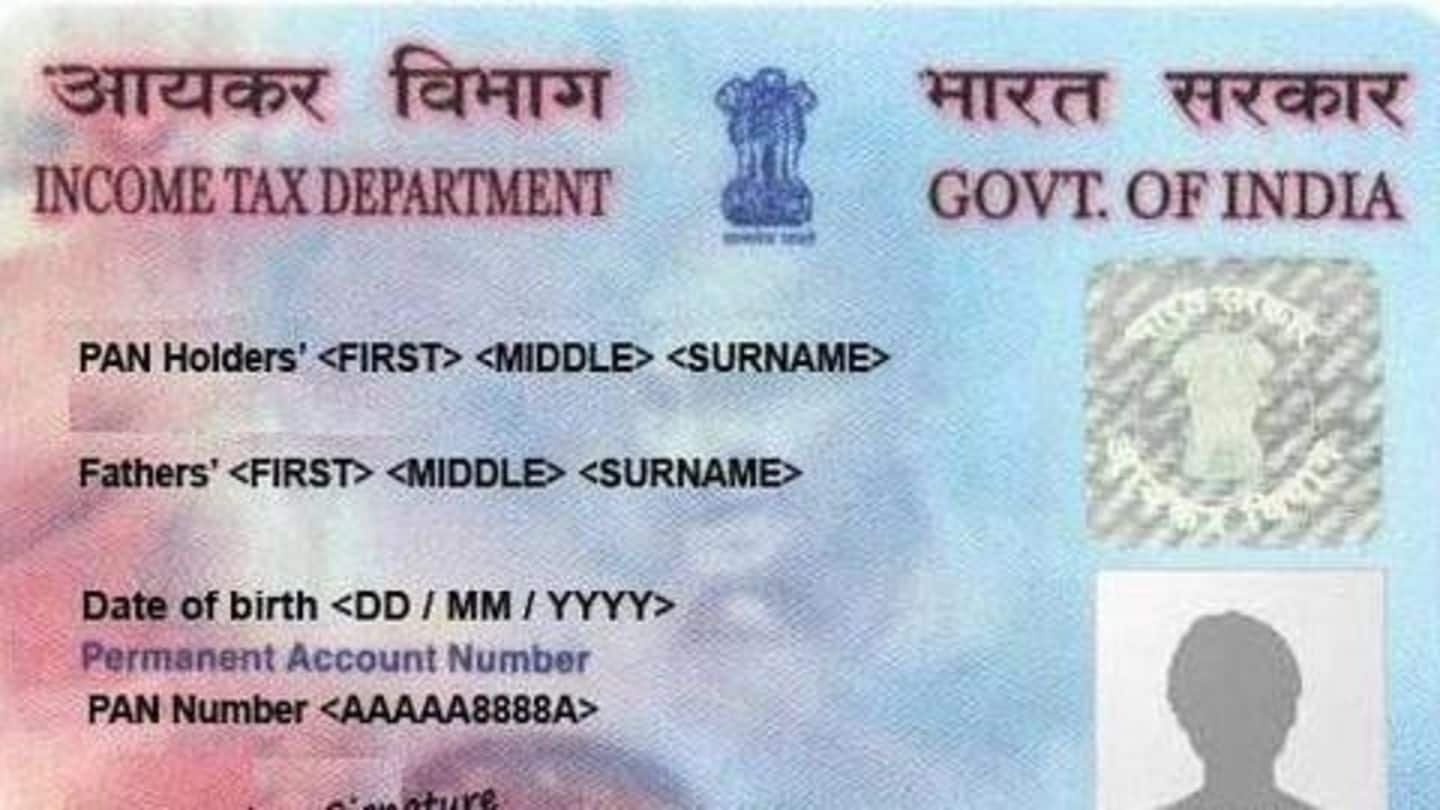

Permanent Account Number (PAN) is a unique, ten-digit alphanumeric identity issued by the Income Tax department to all taxpaying entities in India. PAN facilitates instrumental financial transactions such as tax payments, entering certain financial contracts, and filing I-T returns, among others. It also serves as a government-verified proof of identity. Here's how you can apply for instant e-PAN online using your Aadhaar.

Details

Important things to know about the instant e-PAN facility

The free-of-cost service will reportedly be rolled out in the next few weeks. As part of the procedure, you will have to quote your Aadhaar number, following which a one-time password (OTP) will be sent to your registered mobile number. This OTP will be used to verify your Aadhaar details. Since Aadhaar carries your personal data, there's no need to furnish any other document(s).

Procedure

Procedure to get an instant e-PAN online

Firstly, go to the online NSDL PAN application portal. Then, click on 'Apply for new PAN card' (Form 49A). Enter the required information, viz. PAN number, Aadhaar details, and Date of Birth. Next, upload images of signature and a recent photograph. Finally, make payment. Subsequently, a 15-digit acknowledgment number will be issued to you. You can also take printout of your e-PAN, if needed.

Alternatives

If you don't have PAN, use these two documents instead

If/until you don't have PAN, you can use these documents instead: 1) Aadhaar card: Recently, the government announced that PAN and Aadhaar can now be used interchangeably. Thus, taxpayers are free to quote their Aadhaar number for services where quoting of PAN is otherwise necessary. 2) Form 60: You can also fill up Form 60 and use it as a replacement for PAN.

Linkage

Separately, it is mandatory to link PAN-Aadhaar by December 31

Meanwhile, please note that it is mandatory to link your PAN with Aadhaar. December 31, 2019 is the last date to do the linkage. Earlier, this deadline was September 30. Now, if a taxpayer fails to meet the new deadline, their PAN would be rendered "inoperative". Here's the procedure to link the two documents online and via SMS.

How to link

Here's how you can link your PAN and Aadhaar online

To link PAN with Aadhaar online, log on to the Income Tax e-portal. Next, under the 'Quick Links' section, click on 'Link Aadhaar.' Enter details such as Aadhaar number, PAN, name, and captcha code. Submit the details, click on 'Link Aadhaar', and you're done. After successful verification from UIDAI, linkage will be confirmed. Notably, you can also link the two documents via SMS service.

Information

You can also link your PAN and Aadhaar via SMS

To link your PAN and Aadhaar via SMS mode, type a text message in this format: UIDPAN (space) 12-digit Aadhaar number (space) 10-digit PAN, and send to 567678 or 56161 from your Aadhaar-registered mobile number.