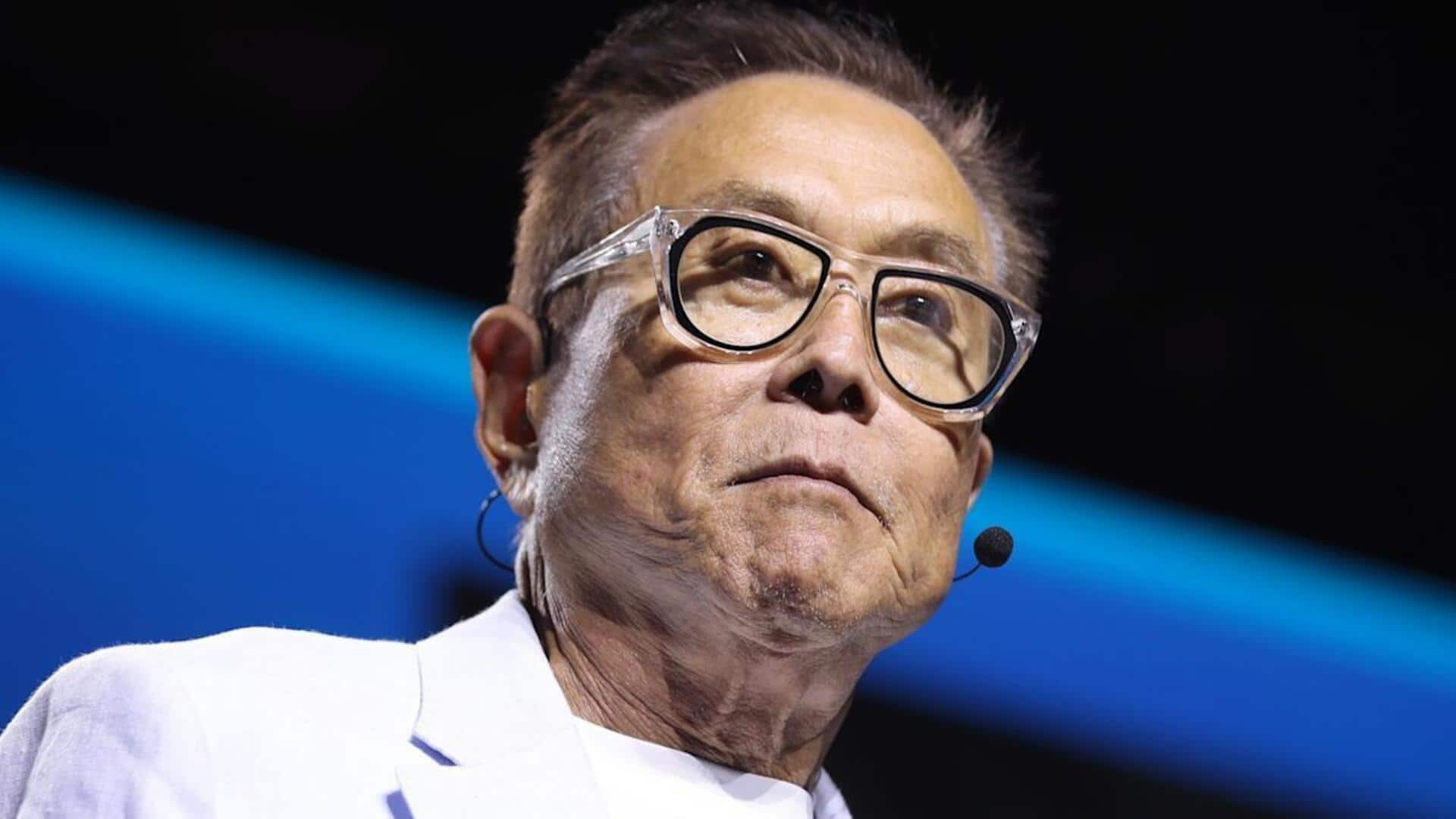

Robert Kiyosaki wants you to buy more gold, silver, Bitcoin

What's the story

Renowned author and financial educator Robert Kiyosaki, best known for his book Rich Dad Poor Dad, has shared his perspective on the recent market downturn. He compared people's reactions during a market crash to their behavior during retail sales. In a post on social media platform X, Kiyosaki said that while poor people rush to buy during Walmart sales, they tend to sell and run away when there's a financial asset market crash.

Investment strategy

'Waiting with cash in hand'

Kiyosaki extended his analogy to the current fall in precious metals and cryptocurrencies, viewing it as a chance to buy rather than a warning sign. He said, "The gold, silver, and Bitcoin market just crashed...a.k.a. went on sale...and I am waiting...with cash in hand...to begin buying more gold, silver, and Bitcoin." This reflects a long-held investing principle that market corrections often provide entry points for those with liquidity and conviction.

Market resilience

CME Group raises margin requirements

Kiyosaki's approach comes at a time when gold, silver, and Bitcoin have witnessed sharp fluctuations after record runs. He doesn't see these swings as reasons to exit but rather as opportunities to prepare capital and step in gradually. This strategy is particularly relevant now as CME Group raised margin requirements following last week's sharp correction in precious metals prices.

Debt strategy

Kiyosaki's debt strategy for real estate

Kiyosaki recently revealed that he strategically uses debt to buy income-generating real estate, which then funds his purchases of gold, silver, Bitcoin, and Ethereum. He emphasized that positive cash flow from property investments allows him to hold onto his silver instead of selling it during market fluctuations. This approach is part of his broader investment strategy amid changing market conditions.

Asset valuation

Silver holds special place in Kiyosaki's outlook

Among all the assets he discusses, silver holds a special place in Kiyosaki's outlook. He has repeatedly described it as one of the most undervalued assets in the current environment. He previously remarked, "Silver is $50 today. I predict silver will hit $70 soon and possibly $200 in 2026." This prediction is based on silver's dual nature as both a monetary and industrial asset due to its extensive use across various sectors.