US appeals court allows Trump's tariffs to stay in effect

What's the story

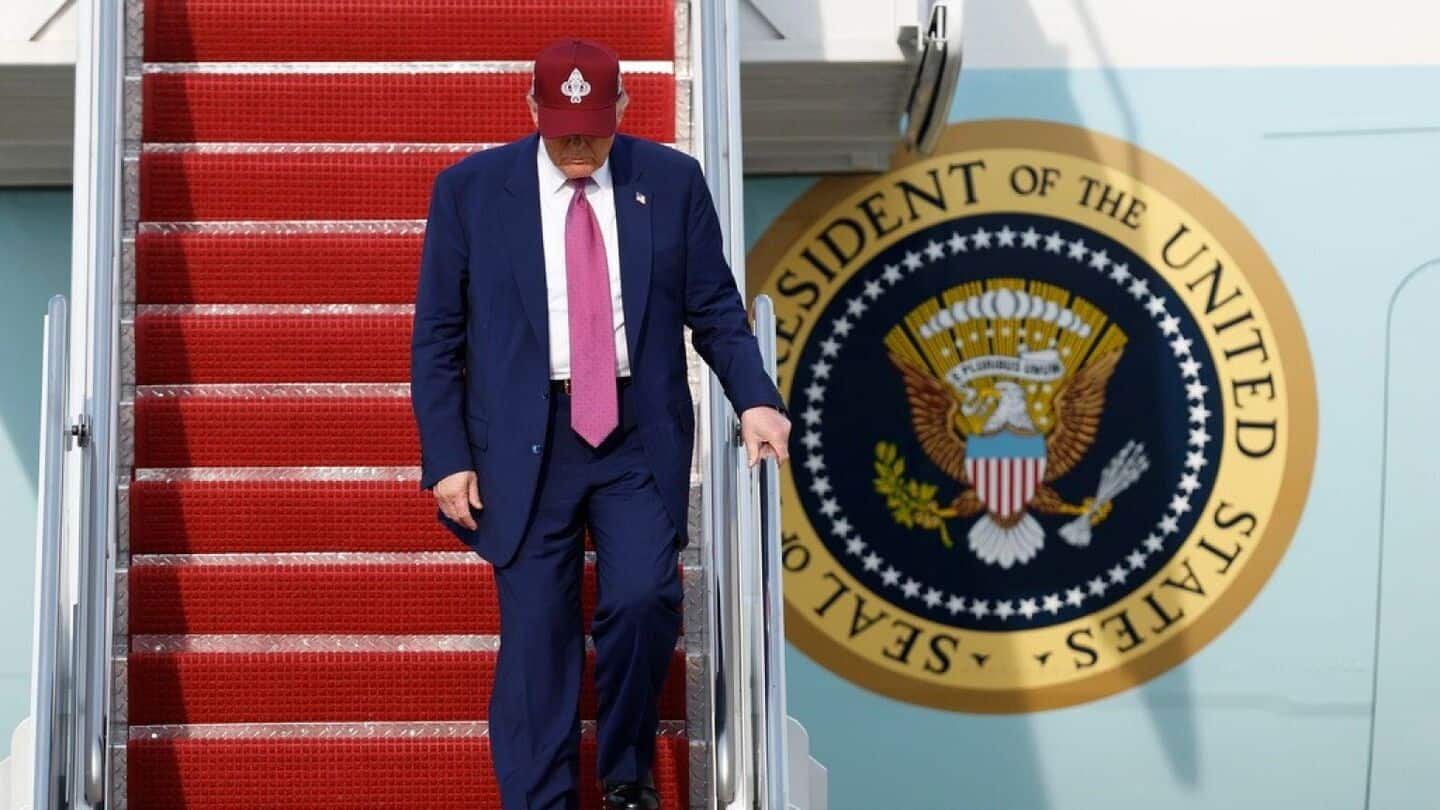

The United States Court of Appeals for the Federal Circuit has ruled that President Donald Trump's tariffs can remain in effect for now. The decision comes as the court reviews a lower court ruling that had blocked the tariffs. The Justice Department argued that concerns over ongoing trade negotiations outweighed economic harm claimed by small businesses.

Legal proceedings

Court puts case on expedited track

The Washington-based court has put the case on an expedited track, citing "issues of exceptional importance." Arguments have been scheduled for July 31. The court did not provide a detailed reason for its decision at this stage but indicated that the government had met its burden for keeping the lower court's injunction on hold. Notably, no judge dissented from this decision.

Tariff justification

Trump administration's arguments

The Trump administration has argued that blocking the tariffs would disrupt US diplomacy and intrude upon the president's power to conduct foreign affairs. The tariffs in question include a global 10% levy, "Liberation Day" tariffs imposed on April 2, and measures targeting China, Canada, and Mexico over fentanyl trafficking. These were imposed under the International Emergency Economic Powers Act (IEEPA) of 1977.

Court ruling

Ruling against Trump

A three-judge panel of the US Court of International Trade had previously ruled that Trump misused an emergency law to impose tariffs. The panel argued that Congress, not the president, has the power to levy taxes and tariffs under the Constitution. They also questioned Trump's claims of "emergencies" over trade deficits and drug trafficking. A dozen Democratic-led states had sued the administration over the tariffs.

Economic impact

Tariffs on steel, aluminum were imposed under different law

The ruling has no effect on other tariffs levied under traditional legal authority, such as those on steel, automobiles, and aluminum imports. The ruling came in a pair of lawsuits, one filed by the nonpartisan Liberty Justice Center on behalf of five small US enterprises that import items from nations subject to the taxes, and the other by 12 US states.