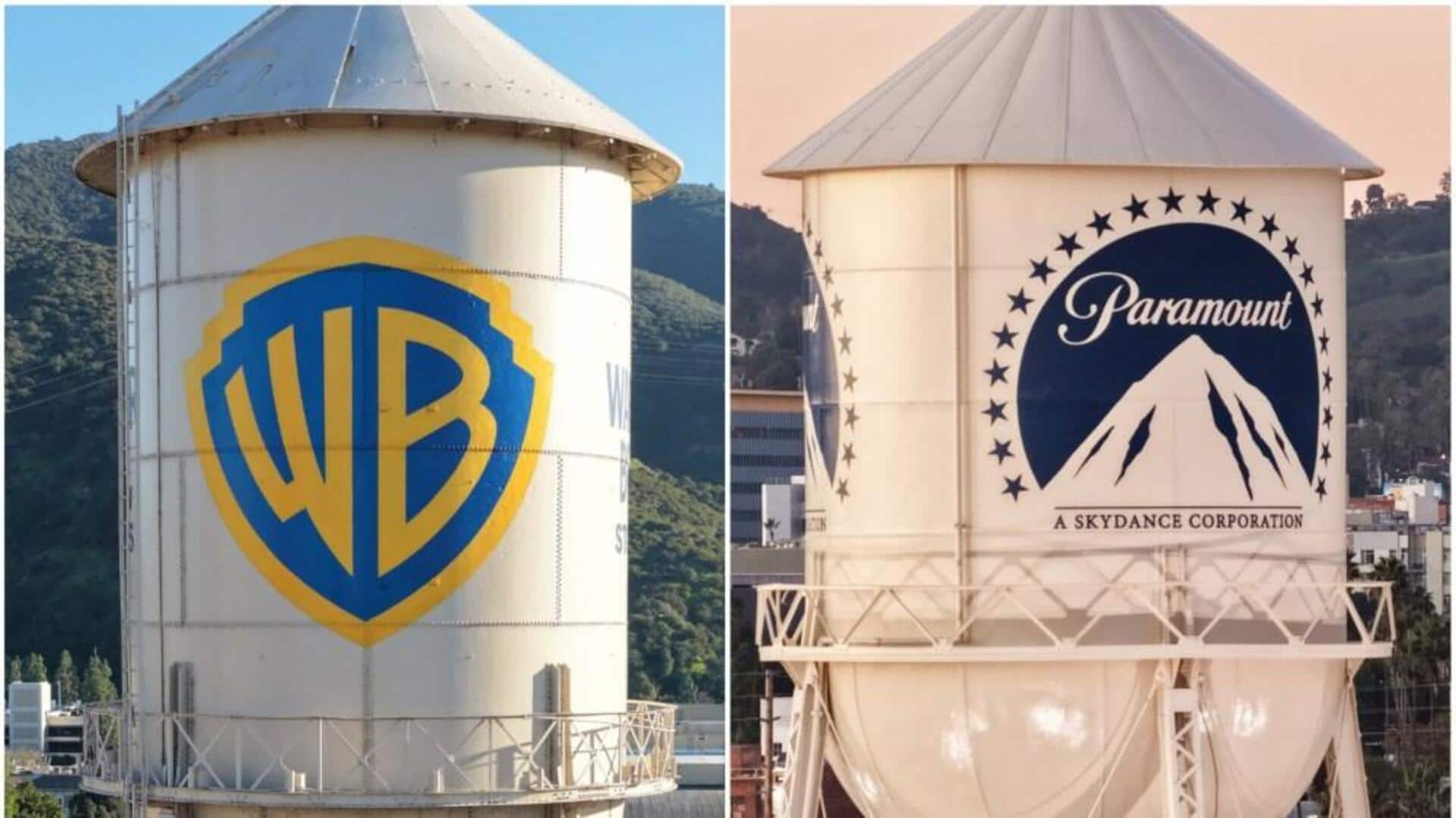

Paramount amends bid to stop Netflix-Warner Bros deal: What's changed?

What's the story

Paramount has intensified its hostile takeover bid for Warner Bros. Discovery (WBD), in a bid to thwart the latter's impending acquisition by Netflix. The entertainment giant, led by David Ellison, has promised WBD shareholders a "ticking fee" of 25 cents per share or $650 million every quarter after December 31, if its deal isn't finalized by then. The offer is in addition to Paramount's existing all-cash offer of $30 per share for the entire company including CNN.

Breakup fee coverage

Paramount will pay WBD's $2.8B breakup fee owed to Netflix

Paramount has also promised to pay the $2.8 billion breakup fee that WBD would owe Netflix if their deal falls through, as per a recent SEC filing. The commitment comes as WBD moves closer to finalizing its $83 billion sale of studios and streaming assets to Netflix. Last month, Netflix made its offer an all-cash one.

Strategic move

More than 93% of WBD shareholders rejecting Paramount's scheme

Despite not increasing its current offer, Paramount's new "enhancements" are aimed at providing WBD shareholders with "certainty in value, a clear regulatory path, and protection against market volatility." The company's shares rose by about 1% on the news. However, there is little evidence that shareholders are backing Paramount in large numbers. WBD recently revealed that "more than 93%" of its shareholders are "rejecting Paramount's inferior scheme."

PR strategy

Netflix warns against Paramount's hostile bid

In response to Paramount's hostile bid, Netflix has stepped up its public relations campaign. On Monday, Netflix's Chief Global Affairs Officer Clete Willems warned against Paramount's proposal during an interview on Fox Business Network. He said that the company "has identified $6 billion in synergies in the offer that they made, which is code for $6 billion in job cuts."

Shareholder meeting

Special meeting for WBD shareholders expected in March-April

WBD's shareholders are tipped to hold a special meeting in late March or early April. Meanwhile, Paramount has extended the deadline for its tender offer as it seeks more shareholder support. The company has also started soliciting proxies to challenge WBD's agreement with Netflix. Despite the developments, Warner yesterday confirmed it received Paramount's "amended, unsolicited tender offer" but was not changing its recommendation for the Netflix deal at this time.