RBI increases key repo rate by 35 bps to 6.25%

What's the story

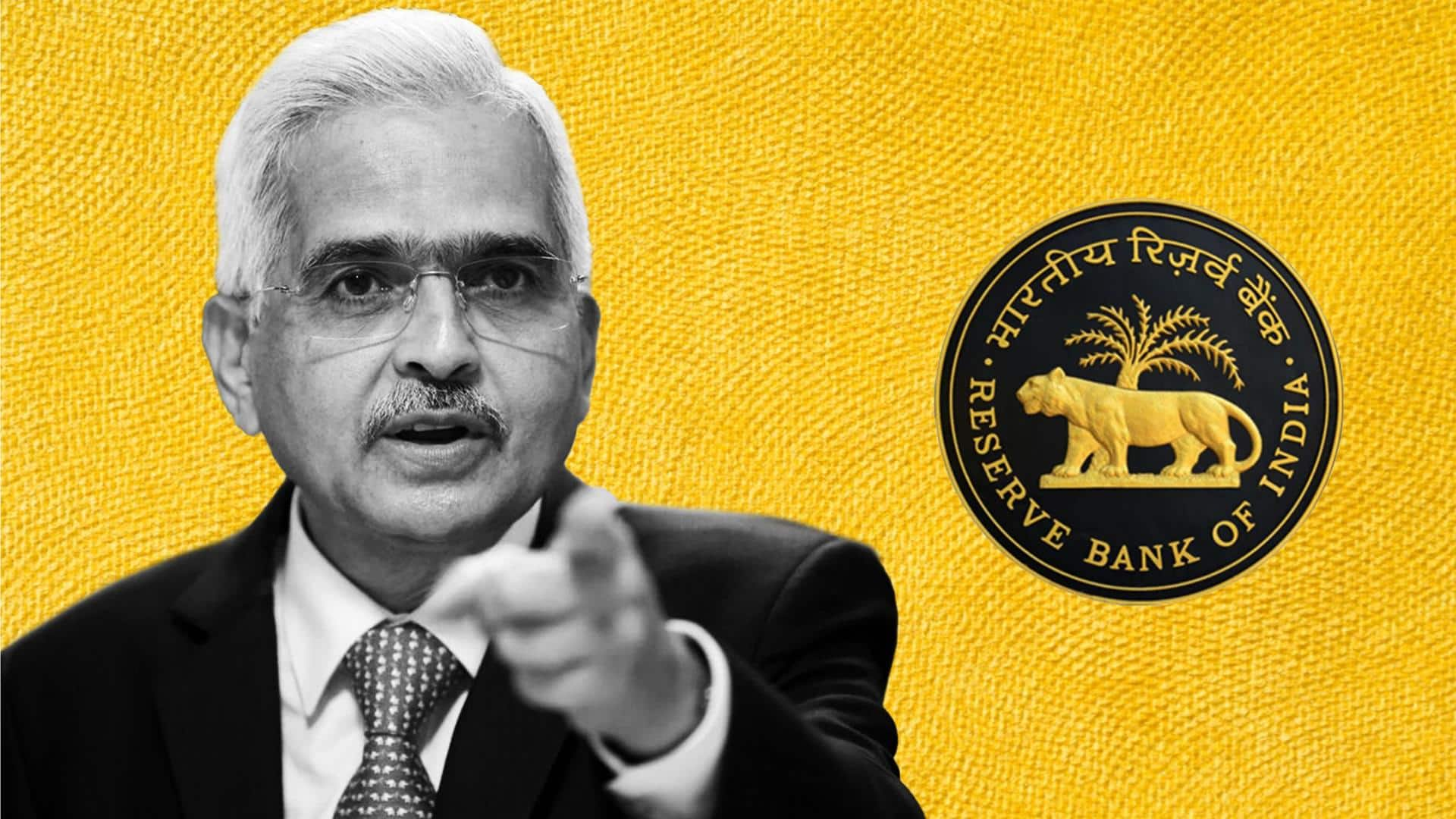

The Reserve Bank of India (RBI) increased its key lending rate on Wednesday by 35 basis points to 6.25%. The announcement came after the Monetary Policy Committee (MPC) meeting. "Our financial system remains robust and stable, and corporates are healthier than before. India is widely seen as a bright spot in an otherwise gloomy world," said RBI Governor Shaktikanta Das in his statement.

Context

Global economy under midst of uncertainty: Das

"Global economy under midst of uncertainty; shortage of food and high fuel prices has affected poor most," the RBI Governor added. The repo rate can be defined as the rate at which the central bank loans money to all commercial banks. On Monday, the Reserve Bank's rate-setting committee began planning for the next round of monetary policy.

Twitter Post

'CPI inflation forecast for January-March 2023 raised to 5.9%'

CPI inflation forecast for October-December 2022 raised to 6.6% from 6.5%. CPI inflation forecast for January-March 2023 raised to 5.9% from 5.8%. CPI inflation forecast for April-June 2023 retained at 5.0%. CPI inflation is seen at 5.4% in July-September 2023: RBI Governor pic.twitter.com/yhbckMftWn

— ANI (@ANI) December 7, 2022

Information

5th rate hike by RBI

The MPC, which includes three RBI members and three outside members, cited slowing price pressures for the nominal hike rate amid consumer-price-based inflation that relaxed to three-month low of 6.77% in October from last year and is set to drop further. This marked the fifth rate hike, after a 40 basis points (bsp) hike in May and by 50bsp in June, August, and September.

Quotes

Inflation expected to be above 4% next year: Das

"RBI surveys show consumer confidence has further improved. Manufacturing and infrastructure firms are optimistic about the outlook," the RBI Governor was quoted as saying by news agency ANI. "Manufacturing, services PMI for India in November among the highest in the world. Inflation is expected to be above 4% in the next 12 months," he added.

Report

Impact of RBI's rate hike

Since May, the Reserve Bank of India has increased the benchmark rate by 2.25% to bring down domestic retail inflation. While the rate hike on Wednesday is only minor, it is still set to weigh heavily on the already-tested monthly household budgets coping with higher borrowing costs and an increase in the cost of nearly everything.

Numbers

Indian rupee has appreciated by 3.2% during April-October: Das

Indian banks are set to pass on the new RBI hike rate to their customers instantly, making loans more expensive and resulting in higher Equated Monthly Installments. "Indian rupee has appreciated by 3.2% during April-October in real terms, while other major currencies have depreciated," Das said. "FDI inflows rose to $22.7 billion in April to October 2022 from $21.3 billion last year," he added.