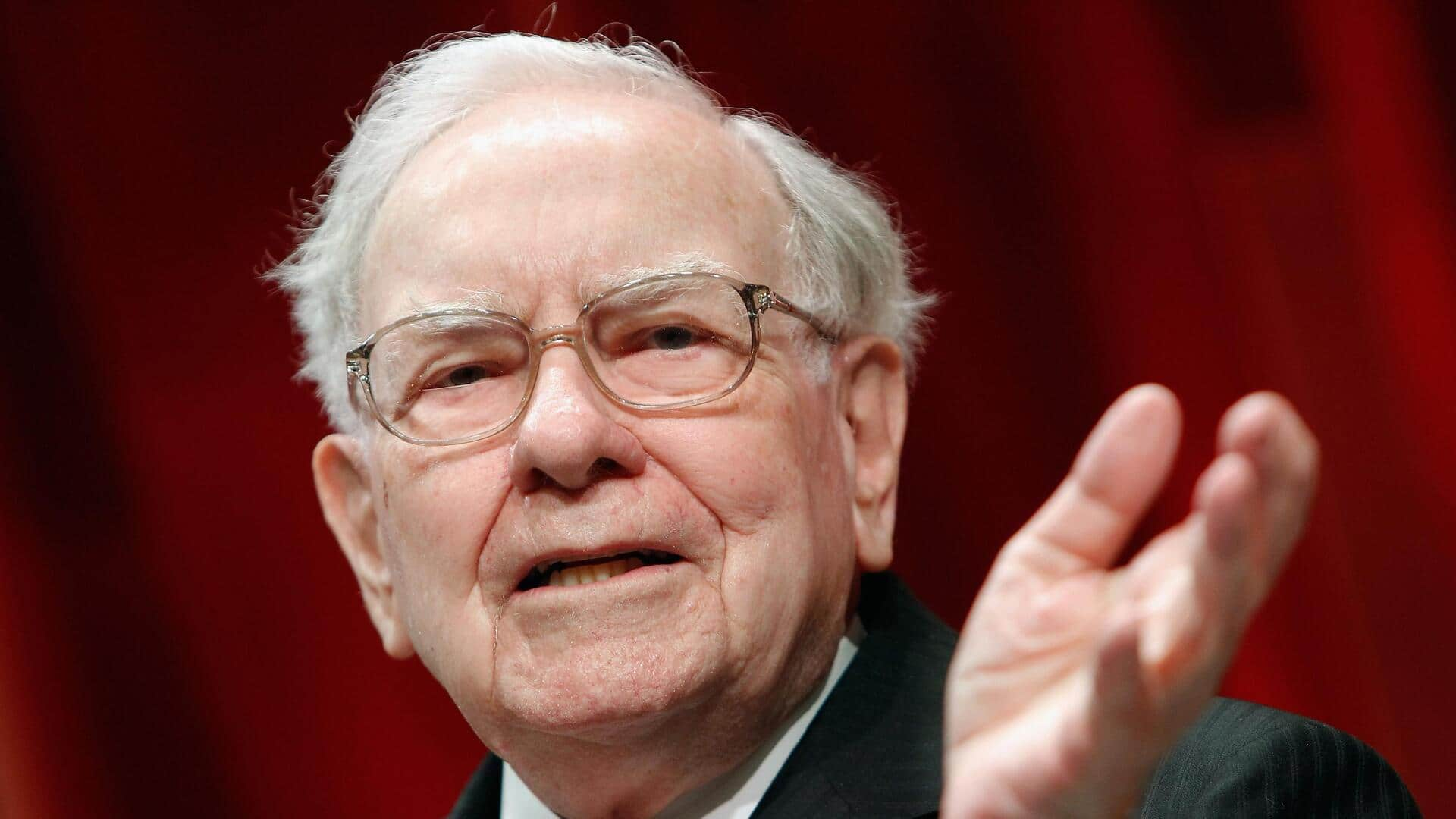

Warren Buffett warns US dollar could be 'going to hell'

What's the story

In his final appearance as CEO of Berkshire Hathaway, Warren Buffett has expressed concerns about the future of the US dollar. Speaking at the company's 60th annual shareholder meeting in Omaha, the 94-year-old investment icon said, "Obviously, we wouldn't want to be owning anything that we thought was in a currency that was really going to hell." "There could be... things happen in the United States that... make us want to own a lot of other currencies," he added.

Fiscal worries

Buffett's concerns about US fiscal policy

Buffett's comments weren't merely a prediction of the dollar's demise, but also an indication of his worries over the long-term viability of US fiscal policy. He hinted that certain conditions could prompt Berkshire Hathaway to consider investing in foreign currencies. "I suppose if we made some very large investment [in a] European country... there might be a situation where we would do a lot of financing in their currency," he said.

Trade concerns

Trade policies and their implications

Buffett also spoke against aggressive trade policies, without naming the US President Donald Trump directly. "Trade should not be a weapon," he said, referring to recent tariffs on Chinese imports. His remarks came amid fears of another global trade war as the US imposed duties of up to 145% on Chinese goods and China retaliated with 125% tariffs.

Global view

Buffett's perspective on America's global standing

Buffett also shared his view on America's position in the world, saying, "It's a big mistake, in my view, when you have seven and a half billion people that don't like you very well." He asked Americans not to forget how far the country has come. Despite his worries about the dollar and trade policies, Buffett reiterated his faith in American business and long-term investing.